Cisco, a prominent networking hardware maker, has recently faced significant challenges, leading to a decline in its shares. The company’s glum forecast for the current quarter and the full fiscal year has caused its stock to plummet. Let’s examine the reasons behind Cisco’s struggles and analyze its performance compared to market expectations.

In the first fiscal quarter, Cisco reported earnings of $1.11 per share, adjusted, exceeding analysts’ expectations of $1.03 per share. Similarly, the company’s revenue of $14.67 billion surpassed the projected $14.61 billion. While these figures appear positive, they mask deeper issues within Cisco’s operations.

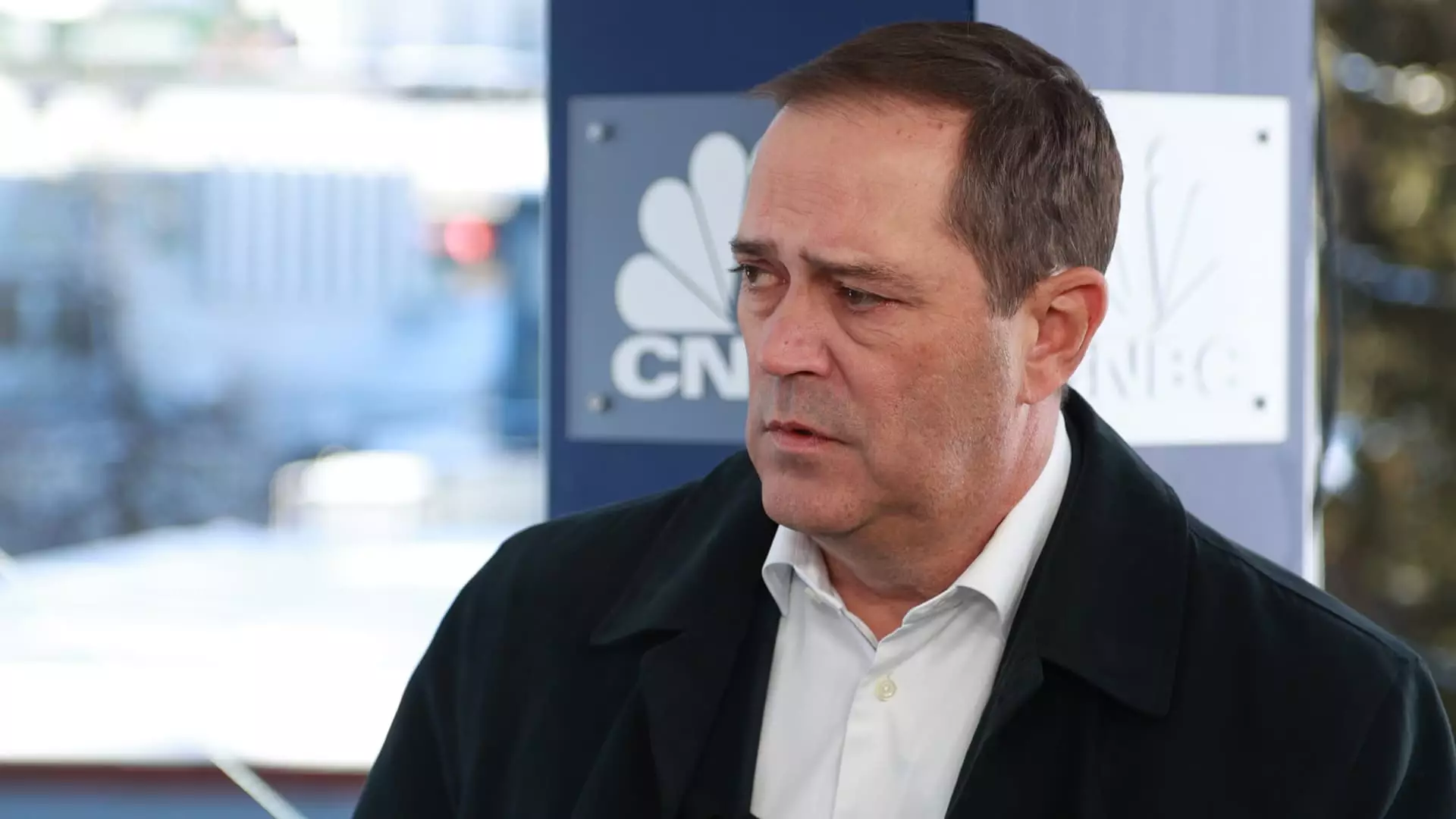

Cisco attributes the slowdown in new product orders to clients being preoccupied with installing and implementing products from the previous three quarters, resulting in a temporary decrease in demand. Cisco’s CEO, Chuck Robbins, acknowledged this issue during a conference call with analysts, emphasizing that customers and sales organizations have expressed their concerns over the past 90 days. However, Robbins also highlighted that sales cycles remain longer than usual, indicating potential challenges in shifting the market’s dynamics.

Cisco projects that one or two quarters of shipped products are waiting to be implemented, underscoring the need to overcome existing bottlenecks in the adoption process. This delay further dampens Cisco’s revenue expectations. The company forecasts a 6.6% revenue decline for the fiscal second quarter, with adjusted earnings per share between 82 cents and 84 cents. This estimate falls significantly short of analysts’ predictions of 99 cents in adjusted earnings per share on $14.19 billion in revenue.

As a response to these challenges, Cisco revised its full-year forecast, reducing expectations for revenue while increasing its outlook for earnings. The company now anticipates adjusted earnings per share of $3.87 to $3.93 on revenue ranging from $53.8 billion to $55.0 billion. In contrast, the previous guidance projected adjusted earnings per share of $3.19 to $3.32 and revenue of $57.0 billion to $58.2 billion. Analysts surveyed had expected earnings per share of $4.05 and revenue of $57.76 billion, indicating a significant gap between Cisco’s outlook and market expectations.

During this challenging period, Cisco made headlines with its plans to acquire data analytics software maker Splunk for a staggering $28 billion. This acquisition could provide the company with new opportunities for growth and innovation.

Additionally, Cisco aims to secure over $1 billion worth of orders for AI infrastructure from cloud providers by the 2025 fiscal year. Cisco’s CEO believes that aligning with cloud providers and offering a broader range of technologies, such as Ethernet, can facilitate the transition to AI infrastructure. By leveraging its flexibility and strategic partnerships, Cisco aims to regain momentum and capture a significant share of the emerging AI market.

Despite the challenges and negative market sentiment, it is important to note that Cisco shares have experienced a 12% increase year-to-date. However, this growth falls behind the broader market, with the S&P 500 index rising by 17% over the same period. Cisco faces the ongoing task of bolstering investor confidence and demonstrating its ability to navigate challenging circumstances.

Cisco’s recent struggles exemplify the difficulties faced by companies operating in rapidly evolving industries. Despite exceeding analysts’ earnings and revenue expectations in the first fiscal quarter, Cisco’s overall performance fell short due to a slowdown in new product orders and delayed implementation. The company’s adjusted forecasts indicate a need to address these challenges in order to achieve sustained growth. By focusing on strategic acquisitions and capitalizing on emerging technologies like AI, Cisco strives to regain its competitive edge and secure its position in the market. Only time will tell if Cisco’s efforts will result in a successful turnaround and renewed investor confidence.

Leave a Reply