China has recently shown its support for property developers and efforts to resolve local government debt issues during a high-level financial meeting that concluded on Tuesday, according to a state media report. This significant financial work conference is conducted twice a decade and serves as a platform to establish long-term policy directions, which will subsequently guide more detailed actions.

Goldman Sachs’ Maggie Wei and her team have reported that policymakers have emphasized the fair treatment of both private and state-owned property developers, ensuring that their reasonable funding demands are met. To achieve this, policymakers aim to establish a long-term effective mechanism to resolve local government debt. Additionally, they aim to optimize the structure of central and local government debt. It is worth noting that in 2020, Beijing began addressing the issue of property developers relying heavily on debt for growth.

In recent months, Chinese authorities have taken steps to support property developers, who have faced challenges due to defaults and declining home sales. The government has eased restrictions on home purchases and provided assistance to developers in completing apartment constructions, which are typically sold before they are finished. However, it is essential to highlight that while steps have been taken to support the sector, Beijing has not provided a complete bailout. The current expectation is that the real estate sector will contract from its significant share in China’s economy.

The state of the property market has a direct impact on local government finances, which have been burdened by the costs of various measures taken to address the challenges brought about by the COVID-19 pandemic. Therefore, the financial work conference focused not only on property developers but also on resolving local government debt issues, recognizing the intertwined nature of the property market and government finances.

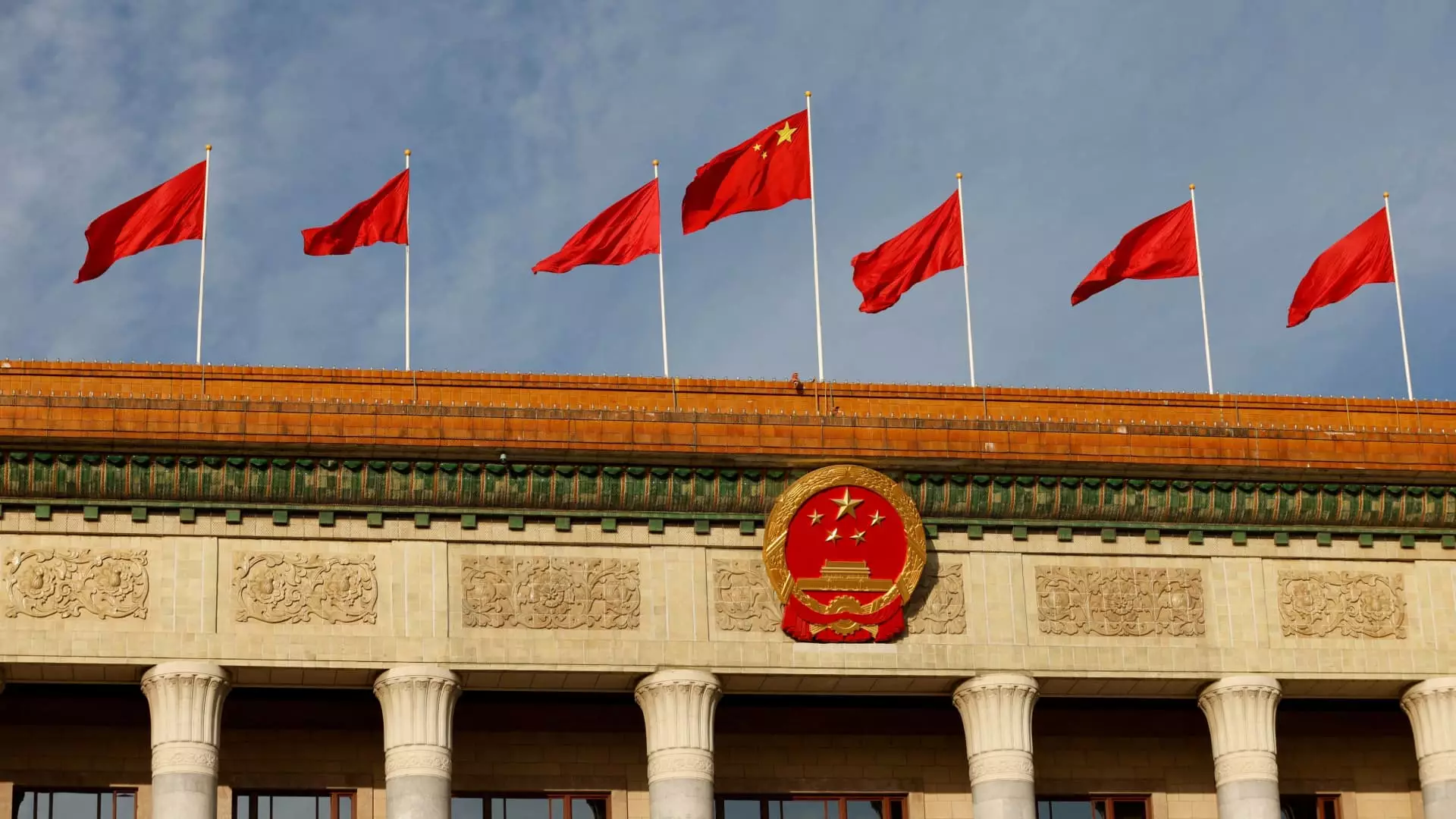

The recent government meeting also highlighted the Chinese Communist Party’s increased oversight of finance. This meeting, delayed by over a year, was referred to as the “central” financial work conference, in contrast to the “national” label used in 2017. Macquarie analysts pointed out that this year’s readout featured fewer mentions of “regulation” and “risk” compared to the previous conference, indicating a shift in focus towards maintaining regulatory pressure to prevent the emergence of new risks rather than embarking on another de-risking campaign.

Chinese President Xi Jinping delivered a keynote speech at the conference, emphasizing the importance of financial development. Premier Li Qiang provided more specific arrangements for financial work, indicating the government’s commitment to addressing the challenges faced by the sector. Vice Premier He Lifeng concluded the meeting and is now the director of the office of the Central Commission for Financial and Economic Affairs, signifying the importance placed on financial matters.

China’s recent financial meeting has demonstrated the government’s support for property developers and efforts to resolve local government debt problems. By emphasizing fair treatment, establishing effective mechanisms, and easing restrictions, policymakers aim to provide necessary support to the sector without engaging in an outright bailout. Additionally, increased oversight of finance and a shift in focus towards regulatory pressure have been observed. The involvement of key figures and their speeches reinforces the government’s commitment to addressing the challenges faced by the financial sector in China.

Leave a Reply