The Consumer Financial Protection Bureau (CFPB), established to safeguard consumer interests in the financial sector, is facing an unprecedented challenge that could redefine its operations. A recent internal memo has informed employees that they need to work remotely due to the closure of their Washington, D.C. headquarters until February 14. This unexpected development, disclosed by CNBC, is indicative of a broader turbulence affecting the agency’s future amidst an evolving political landscape.

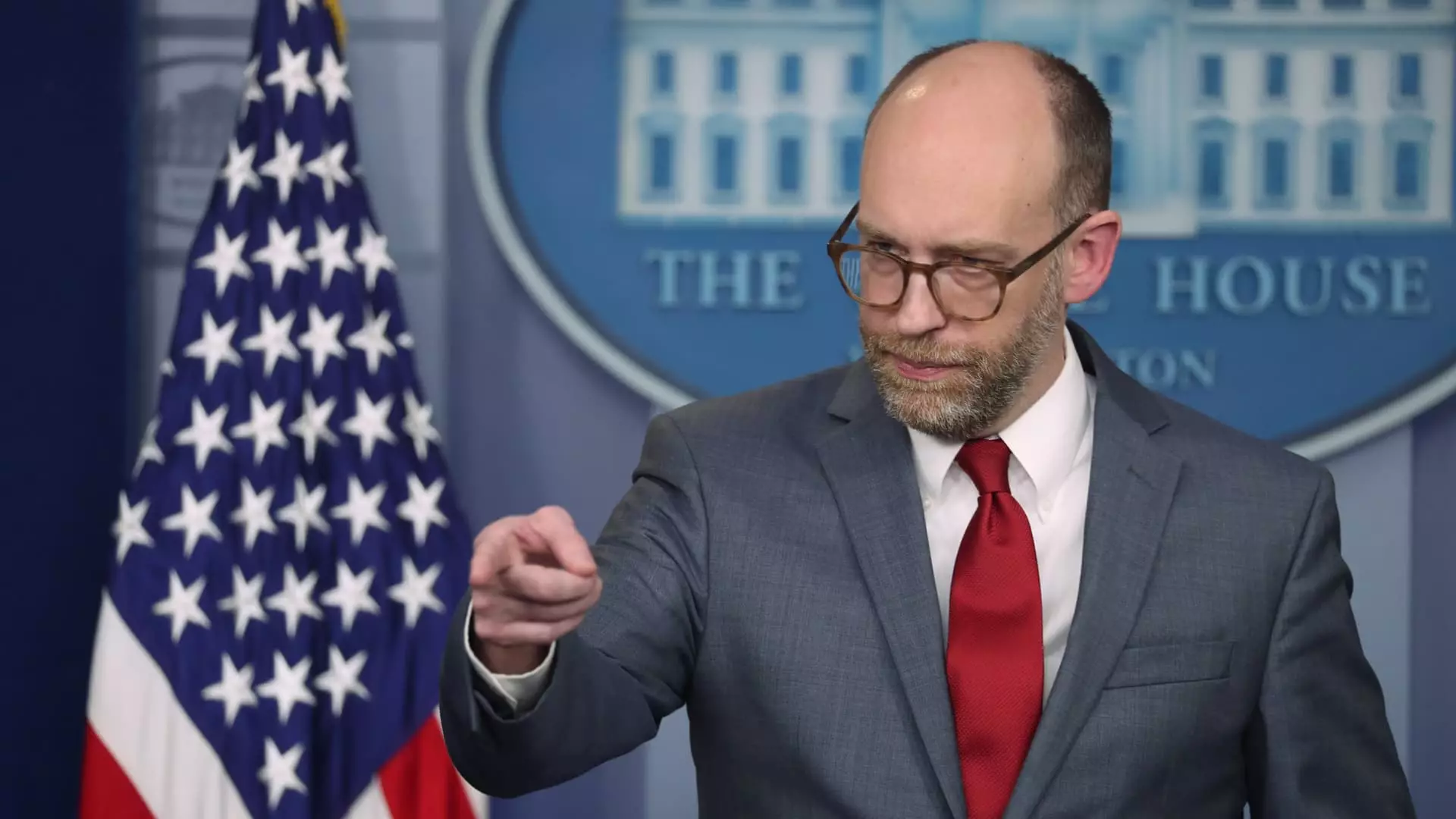

The situation escalated when newly appointed acting director Russell Vought communicated severe restrictions on agency activities. His directive, which essentially puts a halt to supervisory roles over financial institutions, marks a significant shift in the bureau’s functioning. This freeze, communicated through a memo, raises questions about the efficacy and autonomy of the CFPB at a time when regulatory oversight is more critical than ever.

Moreover, the recent arrival of employees from Elon Musk’s DOGE at the CFPB has sparked anxiety among staff. Reports indicate these operatives have gained access to sensitive data sources, including employee performance reviews. Such intrusion into internal operations underscores the potential threat posed by external influences on the CFPB’s effectiveness. Musk’s previous advocacy for dismantling the CFPB, alongside his provocative social media assertions such as “CFPB RIP,” paints a vivid picture of the ongoing tug-of-war over the agency’s mission and integrity.

Compounding the uncertainty, Vought’s announcement on social media regarding the cessation of funding to the CFPB raises critical accountability concerns. By stating that the financial resources contributing to the bureau’s “unaccountability” are now shut off, he is effectively questioning the agency’s operational integrity and funding model. Such a drastic measure could lead to a significant reduction in the agency’s capacity to perform its regulatory duties, leaving consumers vulnerable at a time when robust oversight is essential.

As the CFPB grapples with these challenges, its future appears increasingly precarious. Employees find themselves navigating an environment fraught with anxiety and ambiguity, exacerbated by the leadership’s willingness to adapt policies that could undermine the bureau’s foundational goals. The intersection of regulatory policy, political whims, and external pressures creates a scenario ripe with potential pitfalls for consumer protection.

The CFPB stands at a crossroads, with its mission hanging in the balance. The agency’s ability to function effectively has been significantly undermined, prompting urgent calls for clarity and reassurance from both consumers and financial institutions. The coming weeks will be pivotal in determining whether the CFPB can recover its footing and reaffirm its commitment to protecting consumers in an increasingly unpredictable environment. As developments unfold, stakeholders must remain vigilant and responsive to safeguard the tenets upon which the bureau was built.

Leave a Reply