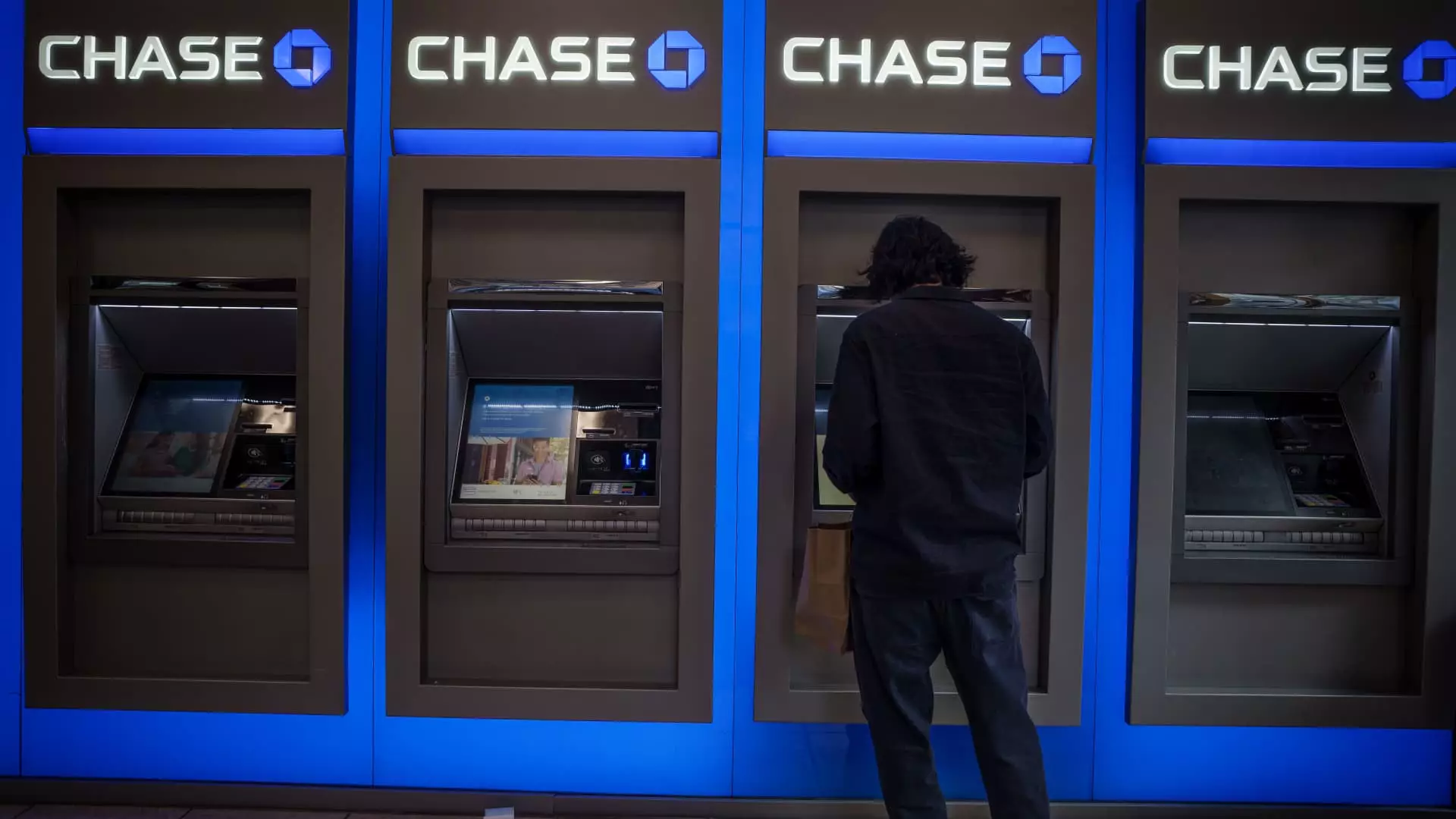

In a notable escalation of measures to combat financial fraud, JPMorgan Chase has initiated legal proceedings against several customers accused of exploiting a significant technical flaw in their ATM systems. This glitch, dubbed the “infinite money glitch,” enabled individuals to withdraw large sums of cash from their bank accounts before a deposited check could be flagged for insufficient funds. The ubiquitous spread of this situation has been fueled largely by social media, particularly platforms like TikTok, which showcased individuals celebrating their illegal windfalls. With legal actions now in play, the broader implications on trust within the financial system come sharply into focus.

As of recent reports, JPMorgan has filed lawsuits in multiple federal jurisdictions, including cases in Houston, Miami, and the Central District of California. One striking case involves a Houston resident accused of extracting nearly $290,000 following the deposit of a $335,000 counterfeit check. According to the details shared by the bank, this fraudulent activity was facilitated by accomplices, emphasizing an organized effort to take advantage of the bank’s systems. This brings to light not only the individual actions of deceivers but also the larger, interconnected nature of financial fraud in the modern age.

The repercussions of this situation extend beyond individual accountability. While JPMorgan has not released specific figures regarding overall losses sustained from these fraudulent activities, the bank is reportedly investigating thousands of potential instances. Last year alone, losses attributed to check fraud globally reached a staggering $26.6 billion. This statistic sheds light on the vulnerability of traditional banking systems and the significant risks posed by outdated financial instruments in an increasingly digital world.

One of the pivotal aspects of this incident is the influence of social media on financial crimes. Videos depicting the misuse of the ATM withdrawals rapidly circulated online, effectively normalizing behavior that is deeply unethical and illegal. The rise of platforms like TikTok has created a space where information—and misinformation—can spread at an unprecedented rate. Such instances remind us of the dual-edge sword that technology represents. While it can facilitate genuine financial transactions and opportunities, it also serves as a breeding ground for fraudsters who leverage its reach to promote and propagate criminal behavior.

The initial response from JPMorgan reflects an understanding that technological advancements come hand-in-hand with new kinds of threats—ones that banks must continuously adapt to counteract. In response to the discovered vulnerability, JPMorgan claims it promptly mitigated the flaw, but the episode raises critical questions about the bank’s readiness to protect customers’ interests.

JPMorgan’s Stance and Future Actions

The lawsuits filed by JPMorgan serve not only as a means to recover lost funds but also as a strong message against fraudulent behavior. The bank is seeking repayment alongside interest and additional fees, indicating their intention not to let these criminal acts go unchecked. It should be noted that these civil actions will run concurrently with potential criminal investigations, as the bank has referred several cases to law enforcement.

Bank spokesperson Drew Pusateri encapsulated the gravity of the situation by stating, “Fraud is a crime that impacts everyone and undermines trust in the banking system.” In a landscape where trust is imperative, this incident is a reminder of the fragile nature of consumer confidence in banking institutions and their ability to manage security.

In the aftermath of this incident, both JPMorgan Chase and its customers must grapple with the ramifications of financial fraud facilitated by technology. Legal action is only one facet of a broader conversation about security, responsibility, and trust. As banks innovate and implement new technologies, they must also fortify defenses against the assorted threats that these advancements inadvertently invite. Moreover, as society continues to navigate the complex interplay between technology and ethical conduct, it becomes increasingly crucial to educate individuals on the consequences of fraud—not only for themselves but for the integrity of the financial ecosystem at large.

Leave a Reply