The financial markets are often seen as a reflection of economic conditions, and the recent surge in technology stocks underscores the influence of monetary policy on investor sentiment. Following the Federal Reserve’s decision to cut its benchmark interest rates for the first time since 2020, the technology sector experienced a notable rally, drawing significant attention from investors. This article delves into the factors driving this resurgence, evaluates the performances of key players, and considers the implications of this trend for the future of technology investments.

The Federal Reserve’s reduction of interest rates can have a powerful effect on various sectors, but its influence is particularly pronounced in the technology space. Lower interest rates decrease the cost of borrowing, making it easier and more attractive for companies to invest in research, development, and expansion. This scenario often leads to increased spending on innovation and technology, which is a cornerstone of growth in the tech sector.

In the wake of the Fed’s announcement, tech stocks experienced a surge, exemplified by a robust 7.4% increase in Tesla’s share price and a 4% jump in Nvidia’s stock. Such gains prompted the Nasdaq Composite Index to rise by 2.5%, featuring one of its most substantial gains of the year. With the market responding positively, the Nasdaq closed at 18,013.98, only 3.5% shy of its peak from mid-July when it reached 18,647.45.

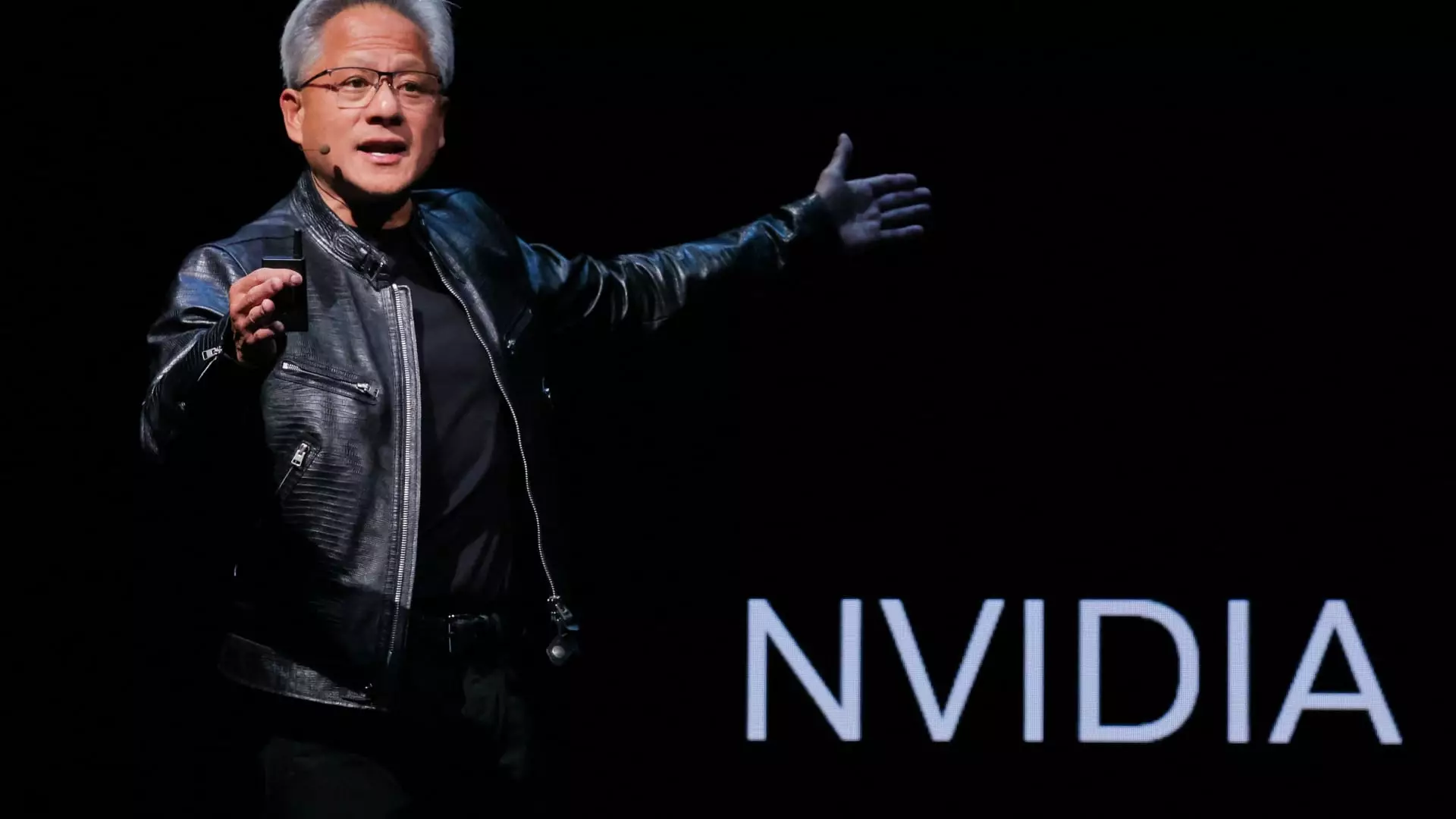

Nvidia has emerged as a significant player in this tech boom, with its processors driving advancements in artificial intelligence (AI). The company’s share price has skyrocketed approximately 138% this year, reflecting its pivotal role in developing technologies that fuel services such as OpenAI’s ChatGPT. As AI continues to transform industries and everyday life, Nvidia’s fortunes are closely tied to its ability to meet the demand from major players such as Microsoft, Meta, and Amazon.

However, dependence on a limited customer base raises concerns about Nvidia’s sustained growth. If any of these companies were to experience a slowdown in their AI initiatives, it could negatively impact Nvidia’s stock performance. Nonetheless, the prospect of continued interest rate cuts adds a layer of optimism for the tech sector, as cheaper capital could serve as a cushion against potential headwinds.

The tech landscape is not solely dominated by Nvidia. Competitors like Advanced Micro Devices (AMD) and Broadcom also enjoyed significant gains, with AMD rising by 5.7% and Broadcom increasing by 3.9%. Despite AMD’s current position as a challenger to Nvidia in the AI arena, the company’s performance year-to-date reflects a more cautious approach. CEO Lisa Su emphasized the long-term nature of AI development, advocating patience as innovations unfold over years rather than months.

This perspective is critical for investors who may have been drawn to the tech sector by the allure of short-term gains. The sentiment echoed by Su not only underscores the complexity of technological advancements but also suggests that the race in AI is only beginning. As investments in AI mature, the market could see further transformations that could yield both challenges and opportunities.

The technology sector is not homogenous; companies like Tesla and Meta are witness to their own share of trends influencing their stock performance. Tesla, despite being a laggard in the broader market with a 2% decline year-to-date, rebounded sharply with a 7.4% increase in a single day, highlighting how quickly market conditions can shift. Similarly, both Apple and Meta experienced significant gains, further evidencing a renewed investor confidence in tech stocks.

As this rally continues, it may create a self-reinforcing cycle where positive market sentiment feeds further investments, driving innovation and technological advancements. However, this reliance on external economic factors necessitates a cautious approach for investors, as market dynamics can change abruptly.

The recent rally in tech stocks, propelled by falling interest rates and the burgeoning demand for AI, paints a hopeful picture for the technology sector. Nevertheless, investors must remain vigilant about the intricacies of market dependencies and the broader economic landscape that could impact this growth trajectory. The next few months will be critical in determining whether the tech sector can maintain its momentum or if it will face correction as market realities come into play.

Leave a Reply