Nvidia, once known for its graphics chips in the gaming community, has now become the most valuable public company in the world. With a market cap of $3.33 trillion, the chipmaker has surpassed industry giants like Microsoft and Apple. This tremendous growth in market value is attributed to the exponential rise in Nvidia shares, which have surged by more than 170% this year alone. The company’s stock price saw a significant boost following the impressive first-quarter earnings report in May. Notably, Nvidia’s market cap crossed the $3 trillion mark for the first time, surpassing even tech giants like Apple.

Nvidia’s success can be largely attributed to its stronghold in the market for AI chips used in data centers. With approximately 80% market share in this segment, Nvidia has become the go-to choice for companies like OpenAI, Microsoft, Alphabet, Amazon, Meta, and many others. These tech giants rely on Nvidia’s processors to build AI models and handle large workloads efficiently. In the most recent quarter, Nvidia reported a staggering 427% increase in revenue from its data center business, accounting for a significant 86% of the company’s total sales.

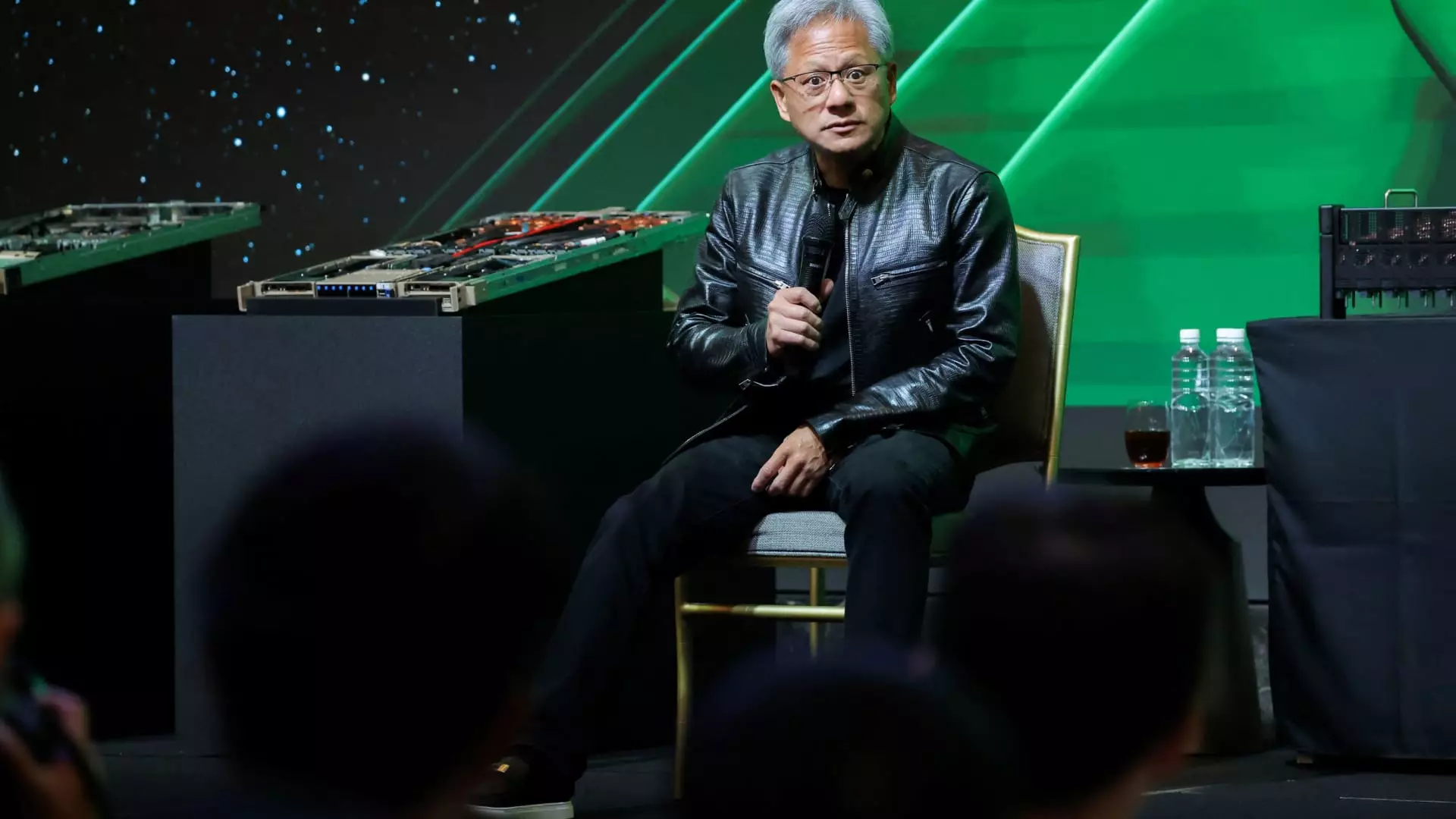

Founded in 1991, Nvidia initially focused on selling chips for gaming purposes. Over the years, the company diversified into areas like cryptocurrency mining chips and cloud gaming subscriptions. However, Nvidia’s true breakthrough came in recent years, with the recognition of its technology as a driving force behind the AI revolution. As Wall Street acknowledged Nvidia’s pivotal role in AI innovation, the company’s stock value soared exponentially. This surge has also propelled CEO Jensen Huang to the ranks of the world’s wealthiest individuals, with a net worth of approximately $117 billion.

While Microsoft has been a major player in the AI boom, with a notable stake in OpenAI, the software giant has also benefited from its partnership with Nvidia. Microsoft extensively uses Nvidia’s GPUs for its Azure cloud service and has integrated AI models into its flagship products like Office and Windows. Microsoft’s market value currently stands at $3.32 trillion, with a 20% increase in its shares this year. The company’s recent launch of AI-powered laptops, known as Copilot+, further solidifies its commitment to AI integration.

Despite being a newcomer to the title of the most valuable public company in the U.S., Nvidia’s rapid ascent has been remarkable. Traditionally, Apple and Microsoft have dominated this position, but Nvidia’s exceptional growth has disrupted this trend. The company’s recent 10-for-1 stock split, which came into effect on June 7, aims to enhance its chances of being included in the Dow Jones Industrial Average. This move is crucial for Nvidia, as the Dow is a price-weighted index where companies with higher stock prices wield significant influence.

Nvidia’s transformation from a niche player in gaming chips to the most valuable public company reflects the evolving landscape of technology and innovation. With a dominant presence in the AI chip market and a focus on cutting-edge technologies, Nvidia is poised to continue its upward trajectory in the tech industry. As the company continues to pioneer advancements in AI and data processing, its position at the helm of the tech industry is well-deserved and indicative of its enduring impact on the future of technology.

Leave a Reply