The recent surge in Nvidia’s shares, surpassing $1,000 for the first time in extended trading, has taken the financial world by storm. The chipmaker’s fiscal first-quarter results have surpassed analyst estimates, showcasing the strength of the AI boom that has captivated markets recently. This surge in shares indicates a growing demand for Nvidia’s AI chips, with CEO Jensen Huang forecasting revenue from its next-generation AI chip, Blackwell, later in the year. The stock rose by an impressive 7% in extended trading, with Nvidia also announcing a 10 to 1 stock split, propelling the shares to reach a fresh high.

Nvidia’s financial performance in the first quarter has exceeded expectations, with an adjusted Earnings Per Share (EPS) of $6.12 compared to analysts’ estimates of $5.59. Additionally, their revenue of $26.04 billion has outperformed the expected $24.65 billion, as forecasted by experts. Looking ahead, Nvidia has set a sales expectation of $28 billion for the current quarter, exceeding Wall Street’s predictions of an EPS of $5.95 on sales of $26.61 billion. The chipmaker reported a net income of $14.88 billion for the quarter ended April 28, showcasing substantial growth compared to the previous year’s figures.

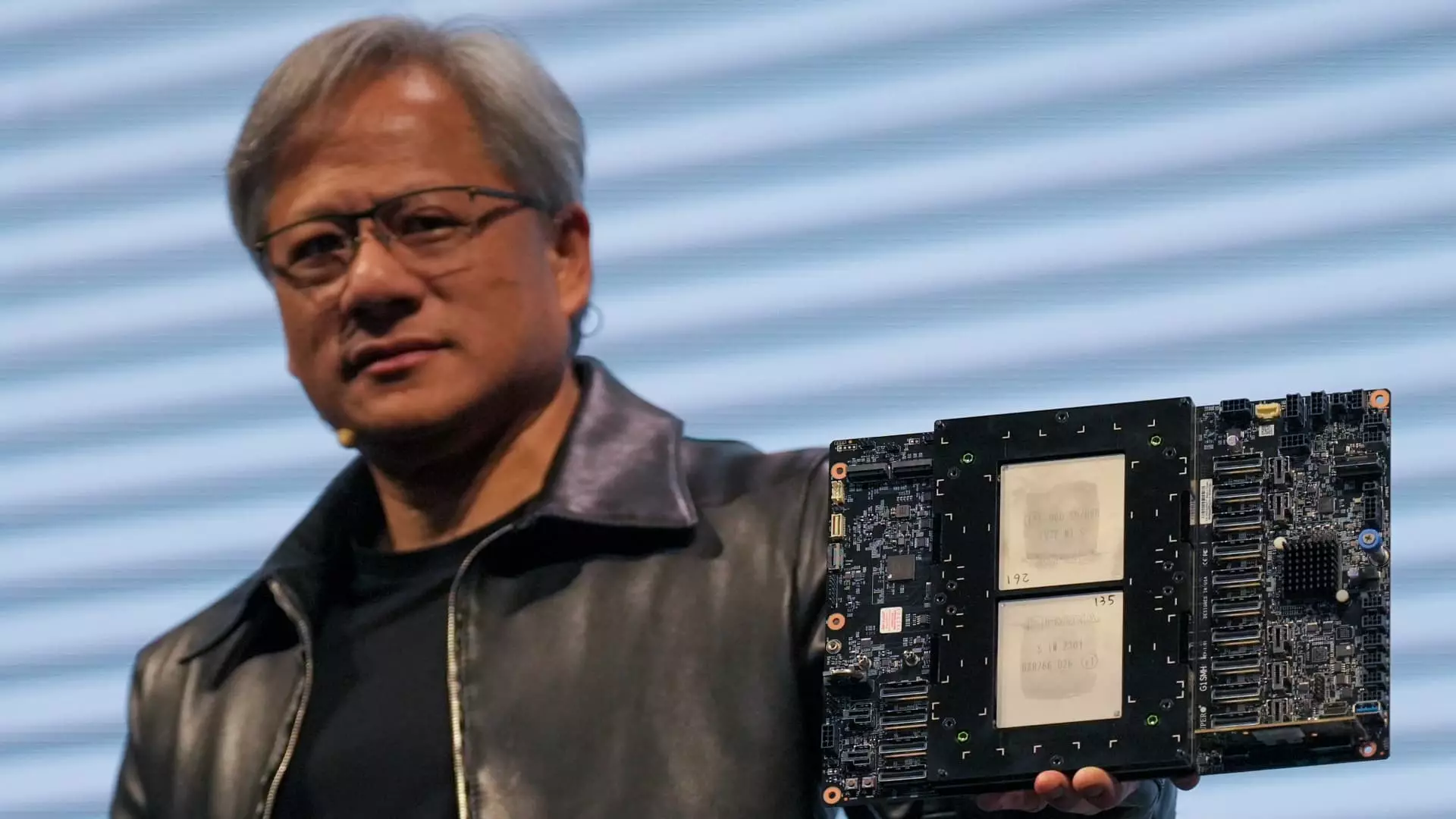

Nvidia’s success can be largely attributed to its data center sales, which have experienced a remarkable 427% rise from the year-ago quarter, reaching $22.6 billion in revenue. The company’s AI chips play a crucial role in this segment, catering to big AI servers utilized by major tech players such as Google, Microsoft, Meta, Amazon, and OpenAI. Notably, Nvidia’s data center revenue has been bolstered by shipments of the Hopper graphics processors, including the H100 GPU. These processors were instrumental in Meta’s announcement of Lama 3, a large language model that utilized 24,000 H100 GPUs, highlighting Nvidia’s pivotal role in AI infrastructure.

While Nvidia has been synonymous with 3D gaming hardware in the past, the company has diversified its revenue streams significantly. Gaming revenue, which saw an 18% increase to $2.65 billion in the quarter, remains a substantial part of Nvidia’s business. In addition to gaming, Nvidia sells chips for automotive applications and advanced graphics workstations, although these segments are relatively smaller compared to its data center business. The company reported $427 million in professional visualization sales and $329 million in automotive sales during the same quarter.

Nvidia’s proactive approach to rewarding shareholders has been evident through its buyback of $7.7 billion worth of shares and payment of $98 million in dividends during the quarter. Furthermore, Nvidia has decided to increase its quarterly cash dividend from 4 cents per share to 10 cents, signaling its commitment to shareholder value. This decision comes in the wake of the company’s stock split, which is poised to enhance liquidity and accessibility for investors.

Nvidia’s recent achievements underscore its position as a key player in the semiconductor industry, with a robust foundation in AI technology and diversified revenue streams. The company’s consistent growth, coupled with its strategic decisions to enhance shareholder value, bodes well for its future prospects in a rapidly evolving tech landscape.

Leave a Reply