Recent polling data suggests that the public views the Conservative party as more likely to raise taxes compared to the Labour party. This perception was formed prior to a televised debate in which the issue of tax policies took center stage. The polling data, conducted by Savanta, revealed that a significant portion of the respondents expressed skepticism towards the promises made by both the Conservatives and Labour regarding tax hikes. Specifically, 41% of the participants stated that they did not believe either party’s assurances on major taxes such as income tax, national insurance, and VAT.

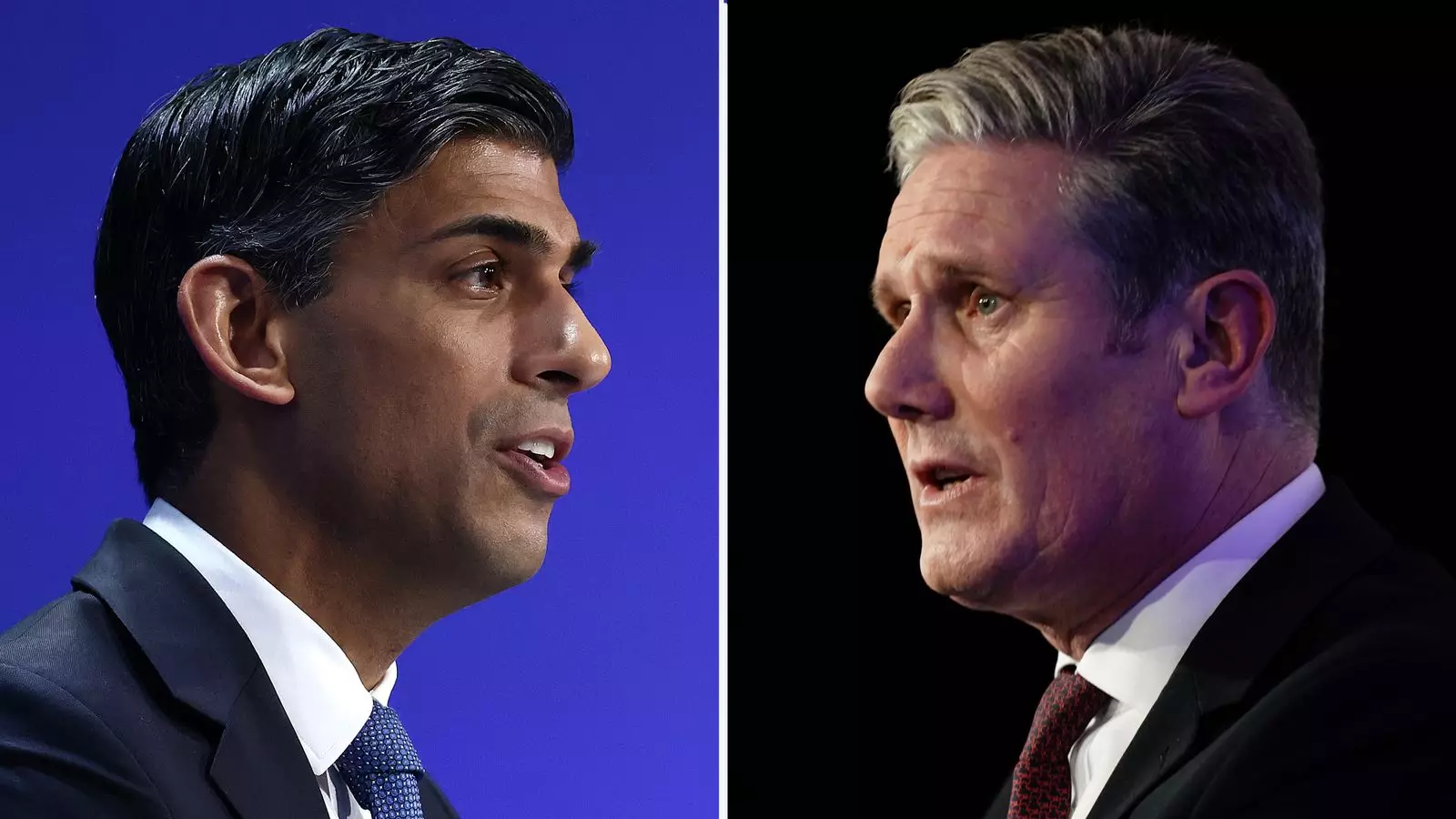

The online survey, which involved 2,217 UK adults aged 18 and above, indicated a higher level of trust in Sir Keir Starmer of the Labour party compared to Rishi Sunak of the Conservative party when it comes to major tax decisions. Only one in six participants believed that Rishi Sunak would not implement significant tax increases, whereas one in four expressed confidence in Sir Keir Starmer’s stance on taxes. The disparity in trust levels between the leaders was further highlighted during the TV debate, where Mr. Sunak accused Labour of proposing uncosted measures that would necessitate a substantial tax burden on families. In response, Sir Keir dismissed these claims as baseless and unsubstantiated.

The debate over tax policies intensified following Mr. Sunak’s assertion of a £38.5bn fiscal shortfall that would need to be addressed over a four-year period. This figure, according to the Prime Minister, was determined by impartial civil servants. However, Labour refuted these calculations, alleging that they were based on assumptions from political advisors rather than an objective evaluation by the Civil Service. A correspondence from the Treasury’s chief civil servant further supported Labour’s stance, emphasizing the importance of accurately attributing financial projections to their actual sources. The controversy surrounding the costings underscored the ongoing scrutiny of the government’s financial accountability by opposition parties.

Generational Divide

The Savanta poll also identified a generational gap in the perception of tax pledges, with individuals aged over 55 exhibiting the highest level of skepticism towards both major parties’ commitments to avoid tax increases. This demographic group holds significant electoral influence, particularly in favor of the Conservative party. Chris Hopkins, political research director at Savanta, noted that Rishi Sunak’s emphasis on tax policy as a defining factor in the election campaign may face challenges due to the public’s diminished trust in the Conservative party’s tax-related assurances. The discrepancy in trust levels across different age groups highlights the evolving dynamics of voter preferences and expectations in contemporary political discourse.

The divergent public perceptions of tax policies between the Conservative and Labour parties reflect broader concerns regarding government transparency, financial accountability, and trust in political leadership. The ongoing debates surrounding tax-related promises, cost projections, and generational voting patterns underscore the complexities of navigating fiscal issues within the electoral landscape. As the election approaches, the efficacy of communicating tax policies and addressing public skepticism will be pivotal in shaping the outcome and public trust in the elected government.

Leave a Reply