Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, has recently taken the reins of Berkshire Hathaway Energy (BHE) after acquiring the remaining 8% of the company that was held by the heirs of Walter Scott Jr., a former director and friend. This acquisition, valued at approximately $2.37 billion in cash and stock, as well as an additional $600 million in debt, signifies a pivotal moment for both Buffett and the utility sector. While the move might initially appear strategic, it underscores some deeper concerns regarding BHE’s performance and future prospects.

Historical Context and Financial Implications

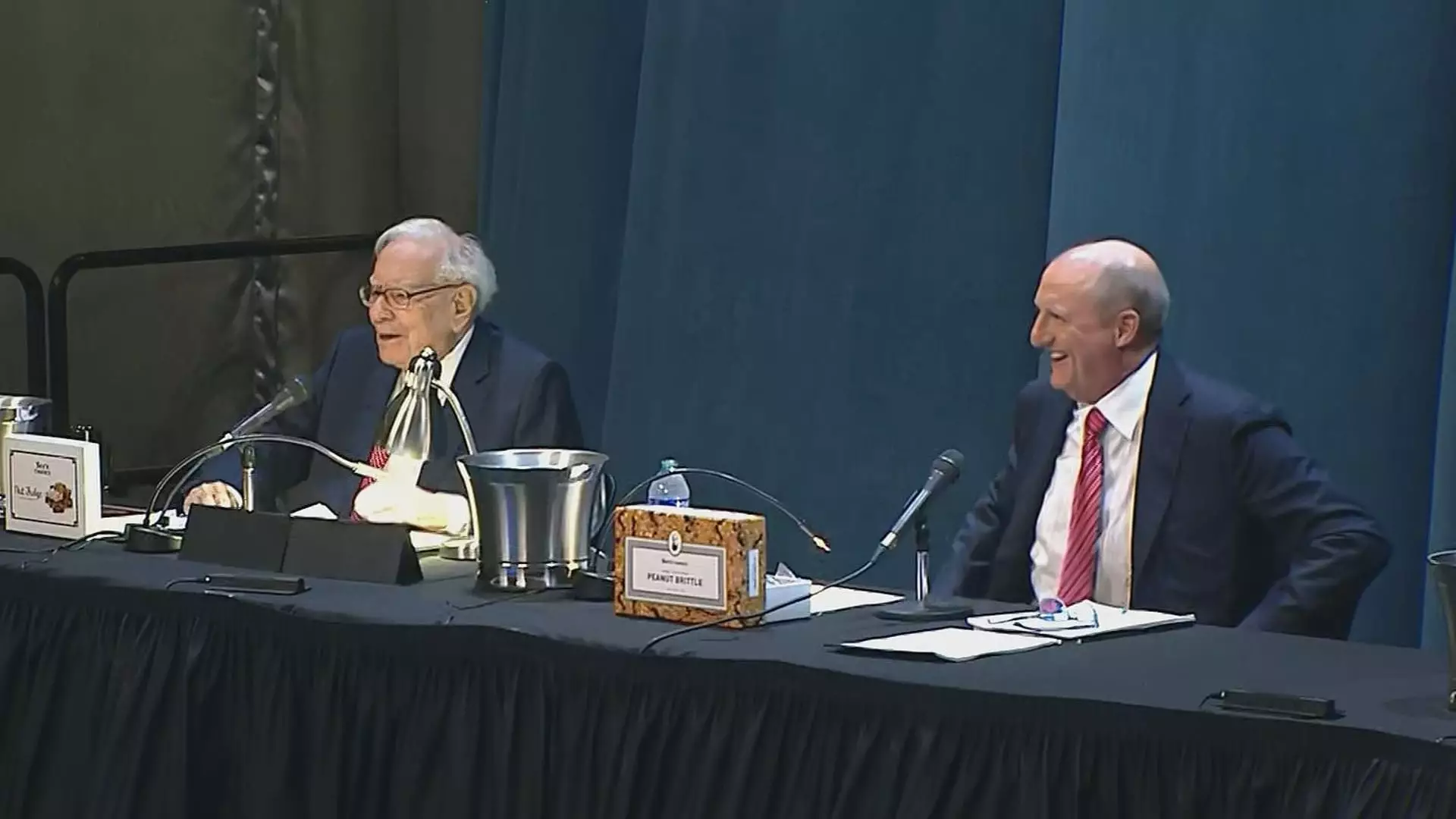

Buffett’s relationship with BHE dates back to 1999 when Berkshire initially secured a majority stake in the utility giant. However, over the years, BHE has struggled amid various challenges, including mounting liabilities tied to wildfires that have plagued its operational stability. With the conglomerate’s recent decision to fully acquire the company, analysts observed that this transaction could represent lower valuations for BHE, suggesting that the chairman may be cautious about the entity’s long-term viability. Bill Stone, chief investment officer at Glenview Trust Company, echoed this sentiment, highlighting Buffett’s reluctance to pay any premium in the acquisition, which reveals lingering worries about the company’s regulatory and operational landscape.

Buffett’s candid assessment of the utility sector reflects a broader concern shared among investors. In his 2023 letter to shareholders, he lamented the unpredictable nature of utility investments, especially following significant forest-fire losses. The evolving regulatory environment, marked by increasing scrutiny and pressure on profitability, has clouded the future of utility investments in vulnerable regions, particularly in the western United States. Buffett’s acknowledgment of a “costly mistake” emphasizes a critical moment for Berkshire as it reassesses its strategy in a sector that was once deemed stable.

Despite the difficulties faced by BHE, Berkshire Hathaway as a whole has thrived in recent years, having recently reached the remarkable milestone of a $1 trillion market capitalization. Yet, BHE remains a weak link in an otherwise robust portfolio. The distinguished investor Greg Abel, who has now relinquished his own stake in the company, further illustrates the challenging landscape BHE navigates. His sale of shares at a higher valuation only two years prior raises additional questions about the current valuation of the utility.

Warren Buffett’s total control over BHE marks not just a corporate maneuver but also a reflection of shifting dynamics within the utility market. As he grapples with the ramifications of recent challenges, the future of the company hangs in the balance. The troubling observations about profitability, coupled with his candid reflections on regulatory changes, suggest that Buffett is now more aligned with a cautious and analytical approach to BHE. While he has a proven track record as an investor, the transition into full control comes laden with complexity and uncertainty that could define the next era for Berkshire Hathaway Energy.

Leave a Reply