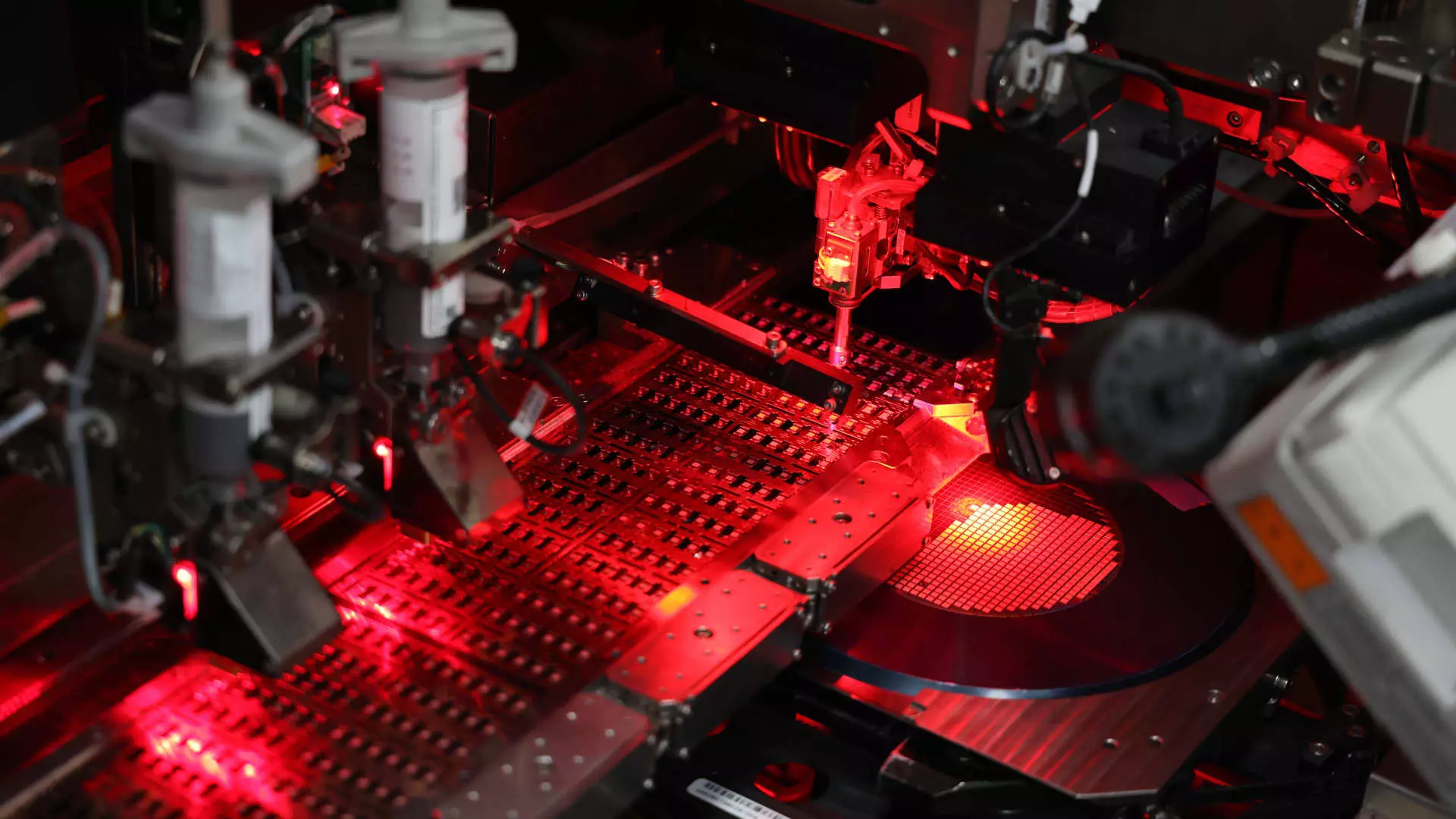

The United States recently issued draft rules aimed at regulating investments in artificial intelligence and other technology sectors in China that could pose a threat to U.S. national security. The rules, published by the U.S. Treasury Department, require U.S. individuals and companies to assess which transactions will be restricted or banned. These regulations are part of President Joe Biden’s executive order to control U.S. investments in semiconductors, microelectronics, quantum computing, and artificial intelligence. The objective is to prevent sensitive technologies from being used by the Chinese to advance and dominate global markets.

Key Points of the Proposed Rules

The proposed rules put emphasis on certain outbound investments in countries of concern and include exceptions for transactions deemed in the U.S. national interest. They would prohibit transactions in AI for specific end uses and mandate notification for transactions related to the development of AI systems or semiconductors not otherwise banned. However, exceptions are made for publicly traded securities, limited partnership investments, buyouts of country-of-concern ownership, and certain debt financings. Transactions involving third countries addressing national security concerns could also be exempted.

Former Treasury official Laura Black warned that U.S. investors would need to conduct more thorough due diligence when investing in China or with Chinese companies in covered sectors. The proposed rules particularly target U.S.-managed private equity and venture capital funds, along with investments by U.S. limited partners in foreign managed funds. Black highlighted that certain Chinese subsidiaries and parents would be subject to the regulations, potentially affecting U.S. companies investing in third countries as well.

The regulations aimed at restricting technology exports to countries like China, especially advanced semiconductors, reflect concerns about modernizing China’s military capabilities. The rules seek to prevent U.S. funds from contributing to China’s technological advancement in key sectors. Violations of the regulations could result in criminal and civil penalties, along with the possibility of unwinding investments. The U.S. has engaged with allies like the European Commission and the United Kingdom to address outbound investment risks collectively.

While the U.S. regulations targeting Chinese technology investments are meant to safeguard national security interests, they also pose challenges for U.S. investors navigating the complex landscape of international investments. Increased due diligence, awareness of the regulations’ scope, and potential implications on investments are crucial for stakeholders in the technology and finance sectors. As the global technology race continues to evolve, regulatory measures like these play a pivotal role in shaping the future of U.S.-China relations and the broader international economic landscape.

Leave a Reply