Goldman Sachs recently introduced two new stock baskets based on corporate asset intensity, a metric that measures the ratio of assets to revenues. The asset-light basket, comprised of companies with low asset intensity, has outperformed the high-asset intensity group by 40 percentage points since 2002. This outperformance is attributed to superior return on equity, which stands at 22% for asset-light companies compared to 15% for asset-heavy companies. In this article, we will delve into the implications of asset intensity on stock performance and highlight some of the companies that have made it into Goldman’s asset-light screener.

Asset-light stocks, characterized by a low asset intensity ratio, are often associated with lean companies that prioritize efficiency and strong growth. These companies require minimal assets to generate revenue, allowing them to achieve higher returns on equity. Semiconductor giant Nvidia, with an asset intensity ratio of 0.5, has been a standout performer with a year-to-date return of 73.1%. The consensus 2024 earnings per share growth for Nvidia is an impressive 87%, reflecting the market’s confidence in the company’s ability to deliver strong financial performance.

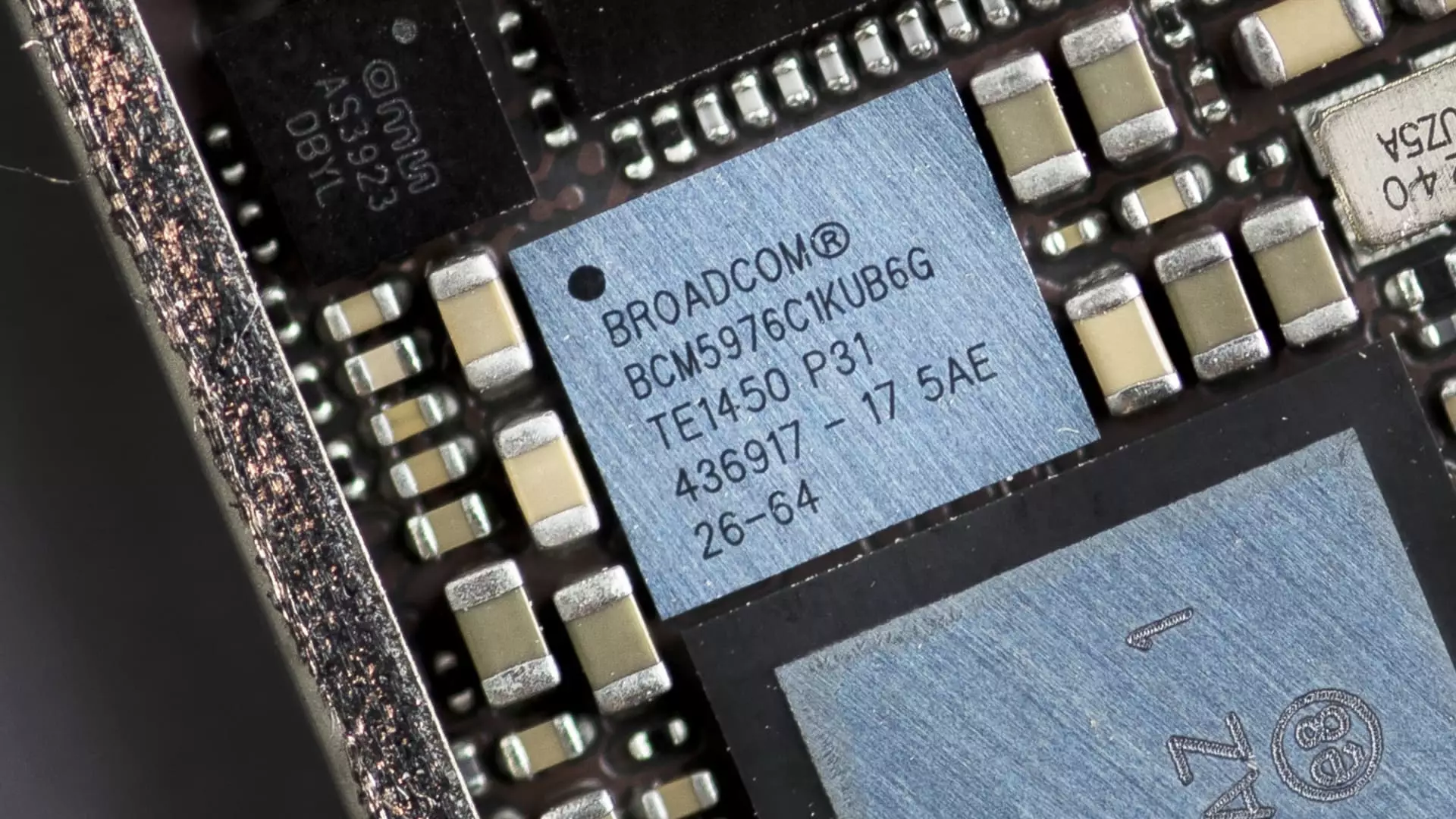

Wall Street analysts remain bullish on asset-light stocks such as Nvidia, Broadcom, Match Group, and Live Nation Entertainment. These companies have demonstrated resilience and growth potential, despite market fluctuations and economic uncertainties. For instance, Match Group, an online dating platform operator, is expected to rally 25.5% in the near future, according to analysts surveyed by LSEG. Similarly, Live Nation Entertainment has outperformed in the past 12 months, with a 36% surge in stock price. Analysts predict a further 44% climb in per-share earnings for 2024, indicating strong growth prospects for the company.

On the other hand, asset-heavy companies in the S & P 500, such as chipmakers Micron Technology, Intel, and On Semiconductor, as well as telecommunication services names AT & T, Verizon, and T-Mobile, face challenges in a low asset intensity environment. These companies may struggle to achieve comparable returns on equity to their asset-light counterparts, leading to underperformance in the market. While asset-heavy companies could potentially benefit from a decline in the cost of capital, they may face headwinds from reduced capital expenditures and slower growth rates.

The concept of asset intensity plays a crucial role in determining stock performance and investment strategies. Asset-light companies have demonstrated resilience and growth potential, outperforming their asset-heavy counterparts over the long term. As investors navigate the complex landscape of the stock market, understanding the implications of asset intensity on company performance is essential for making informed decisions. By analyzing the asset intensity ratio of companies and evaluating their growth prospects, investors can position themselves for success in a dynamic and competitive market environment.

Leave a Reply