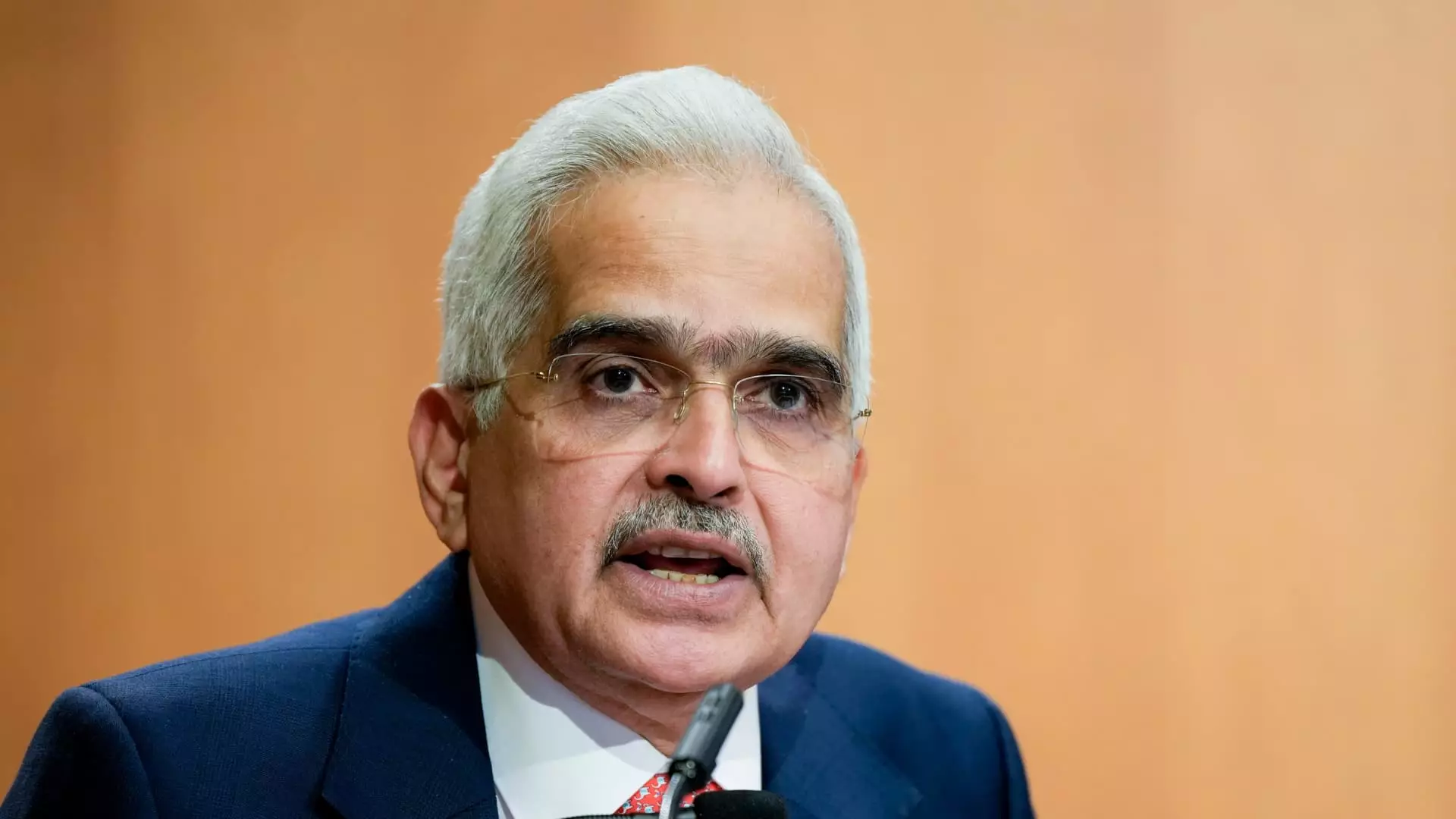

The discourse surrounding central banks has taken center stage in recent discussions about international economies. Reserve Bank of India (RBI) Governor Shaktikanta Das has highlighted the persistent challenges and contradictions standing in the way of consistent economic growth and stability. As global economies strive for equilibrium amidst geopolitical tremors, understanding the implications of central bank policies and strategies becomes crucial for market participants and policymakers alike.

The Landscape of Economic Growth and Inflation

Despite navigating through a phase defined by “continual and unprecedented shocks,” Das asserts that a soft landing for the global economy has been achieved, albeit precariously. The potential resurgence of inflation is a looming specter that could disrupt the stability that many economies are trying to maintain. With the backdrop of ongoing geopolitical conflicts, increases in commodity prices, and significant climate change challenges, a cautious optimism characterizes the sentiment among global financial leaders.

Central banks have historically worked under the tenet of adjusting interest rates to navigate the ebbs and flows of economic turbulence. However, Das pointedly notes that financial markets exhibit a complicated interplay of global dynamics that stretches beyond mere adjustments in monetary policy. The U.S. dollar, for instance, paradoxically appreciates even as interest rates are cut by the Federal Reserve, indicating a convoluted financial landscape shaped by diverse factors.

The complexities of international relations directly influence economic sentiment and stability, illustrating a stark contrast between increasing geopolitical risks and financial markets’ surprising resilience. Despite the rise in global tensions over recent years, markets have managed to showcase a degree of robustness that raises questions about their predictive capabilities. This enduring resilience may reflect a temporary lull in investor confidence, or it could signal a new phase where markets learn to adjust to and anticipate geopolitical changes.

Potential political shifts, such as the possible re-elect of Donald Trump to the White House, may have profound implications on U.S. economic policies, including interest rates and tariffs. Economic analysts are scrutinizing how alterations in trade policies could lead to inflationary pressures, subsequently affecting global markets. This underscores the necessity of staying vigilant and responsive to political developments.

Das sheds light on the disparities within global commodity markets, particularly the divergent trends in the prices of gold and oil. Traditionally, these commodities move in tandem; however, current trends reveal potential shifts in investor preferences and risk appetites. The resilience of gold prices amidst higher bond yields presents a noteworthy anomaly that market observers are keen to analyze further.

Moreover, the rise of government bond yields stands at odds with the decision-making pathways of many advanced economies, which seem to be favoring easing strategies. The implications of these rising yields cannot be overstated, as they can lead to increased borrowing costs that stifle economic growth in a climate where agility is crucial.

As Das surveys the Indian economic landscape, his outlook remains positive despite persistent inflation concerns. The RBI’s decision to maintain a conservative interest rate of 6.5% reflects a larger strategy to ensure that the economy continues to forge ahead robustly. Indian Union Minister of Commerce Piyush Goyal has also urged the RBI to consider cutting interest rates to further invigorate growth, highlighting the need for nimbleness amidst ongoing economic challenges.

India’s growth trajectory stands out in a world striving for economic resilience. The governmental focus on sustainable development and strategic policy-making plays a critical role in sustaining this growth. Das emphasizes that India has navigated hurdles successfully, showcasing its potential to adapt and thrive even amid global volatility.

In sum, the global economy finds itself at a pivotal moment, where central banks play an instrumental role in shaping future trajectories. As geopolitical tensions, inflation risks, and commodity market anomalies persist, insights from leaders like RBI’s Shaktikanta Das are essential for enabling a broader understanding of economic implications. The road ahead may be fraught with challenges, but with informed leadership and responsive monetary policies, there remains potential for achieving stable and sustainable economic growth. The balancing act continues, and vigilance will be key in navigating this complex landscape.

Leave a Reply