Cloud stocks faced a setback on Tuesday as Datadog, a prominent player in the industry, reduced its full-year revenue guidance. This was a direct result of organizations engaging in cost-saving exercises. The WisdomTree Cloud Computing Fund, an exchange-traded fund focused on cloud-oriented companies, experienced a 3% decline for the day. This marked the fifth day of declines in the past six trading sessions, indicating a growing concern among investors.

The cloud-computing sector initially experienced a surge in demand during the Covid pandemic, as more companies, governments, and schools adopted cloud services to support remote work. However, with the rise in inflation and subsequent interest rate hikes by central bankers, investors began selling holdings in fast-growing cloud stocks. They sought safer investments that could provide more consistent returns. Consequently, the cloud industry faced a significant setback.

Escalating Costs and the Need for Savings

The impact of higher interest rates was not limited to the cloud sector. Other industries, such as real estate, also began to show signs of decline. As a result, management teams across various sectors, including cloud companies, started looking for ways to save money on infrastructure and technology expenses. This led to a reduction in overhead costs, sometimes in the form of layoffs. The need for cost-saving measures became a pressing concern for many cloud companies.

Exploring Artificial Intelligence and Cloud Stock Recovery

To adapt to the changing landscape, executives at cloud companies began exploring new technologies that could facilitate the shift towards cost-saving measures. The rise of generative artificial intelligence services, such as OpenAI’s ChatGPT chatbot, garnered significant interest from investors. These emerging AI technologies presented potential solutions that could offer additional tools to aid in the cost-cutting efforts. As a result, cloud stocks started to recover, albeit some of them, including Datadog, have yet to reach their record highs from 2021.

Datadog’s Revenue Guidance Downgrade

Datadog, known for providing cloud-based infrastructure monitoring, reported a growth of almost 83% in revenue year over year for the first quarter of 2022. However, the company lowered its full-year revenue guidance. It now expects revenue to be between $2.05 billion and $2.06 billion, down from the previously forecasted range of $2.08 billion to $2.10 billion. This downgrade implies a reduced growth rate for the fourth quarter, from nearly 23% to just 15%. The analysts’ consensus, according to Refinitiv, had anticipated $2.081 billion in revenue for the full year.

Factors Behind Datadog’s Revised Outlook

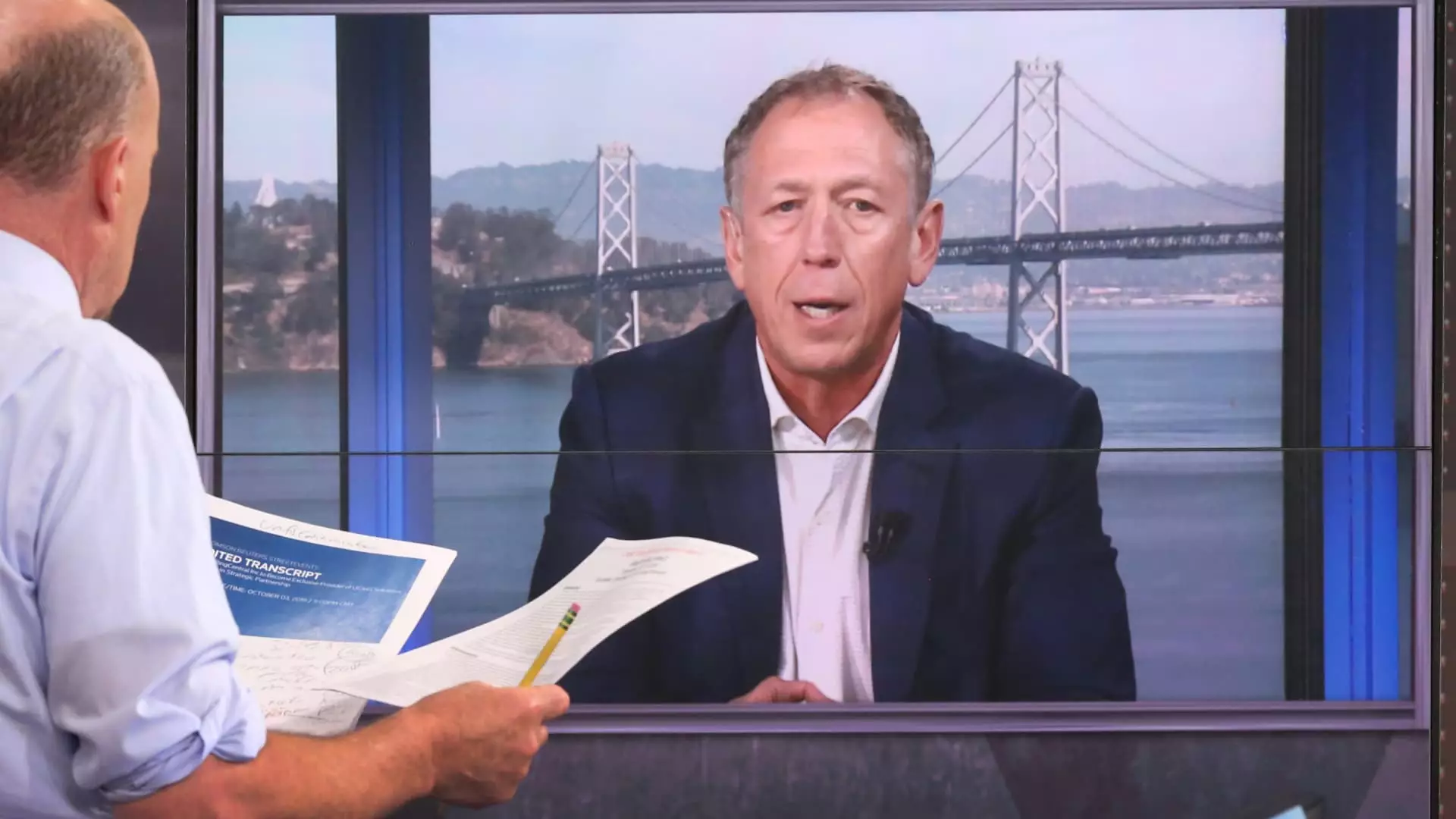

During a conference call with analysts, Olivier Pomel, Datadog’s cofounder and CEO, highlighted that usage growth for existing customers was lower than in previous quarters. Larger spending customers were particularly scrutinizing costs. These factors contributed to Datadog’s decision to revise its revenue guidance. Analysts reacted to the news, with Bernstein Research analysts noting that the stock’s sharp decline was not surprising given its reliance on growth as a key factor for attraction.

Although Datadog experienced a substantial pullback, analysts at Bernstein Research did not completely sour on the stock. They maintained a buy rating while acknowledging the potential for growth to return as enterprise spending budgets recover and venture capitalists resume pouring substantial investments into startups. This indicates that while Datadog faces immediate challenges, there is optimism for its future prospects.

The decline in cloud stocks was not solely attributed to Datadog’s situation. RingCentral, a cloud communications software maker, announced a change in leadership, with Hewlett Packard Enterprise’s finance chief set to become the new CEO. This announcement led to a significant decline in RingCentral’s stock. Everbridge, a company providing software for emergency response, also lowered its growth expectations for the full year and predicted a larger loss than previously anticipated. Other cloud stocks, including Domo, Enfusion, Monday.com, Smartsheet, Snowflake, and Twilio, experienced declines as well.

The cloud stock market faced a setback as organizations engaged in cost-saving exercises and management teams sought ways to reduce overhead costs. Factors such as inflation, interest rate hikes, and lower demand from customers contributed to the decline in cloud stocks. However, there is optimism for recovery as companies explore new technologies and as enterprise spending budgets regain strength. The future of the cloud industry remains uncertain, but its potential for growth and innovation continues to attract investors.

Leave a Reply