The economic landscape has been a topic of interest for many, and Philadelphia Federal Reserve President Patrick Harker provided a strong endorsement for an interest rate cut in September. Speaking from the Fed’s annual retreat in Jackson Hole, Wyoming, Harker directly stated that monetary policy easing is on the horizon. This clear indication of a cut being almost certain when officials meet again in less than a month sets the tone for potential changes in interest rates.

Harker emphasized the need for a methodical approach and expressed the importance of signaling well in advance. While the market has priced in a high probability of a quarter percentage point cut, with a chance of an even larger reduction, Harker remains cautious and stated that further data is needed before making a final decision. This level of transparency and prudence in decision-making is essential in navigating the complexities of monetary policy.

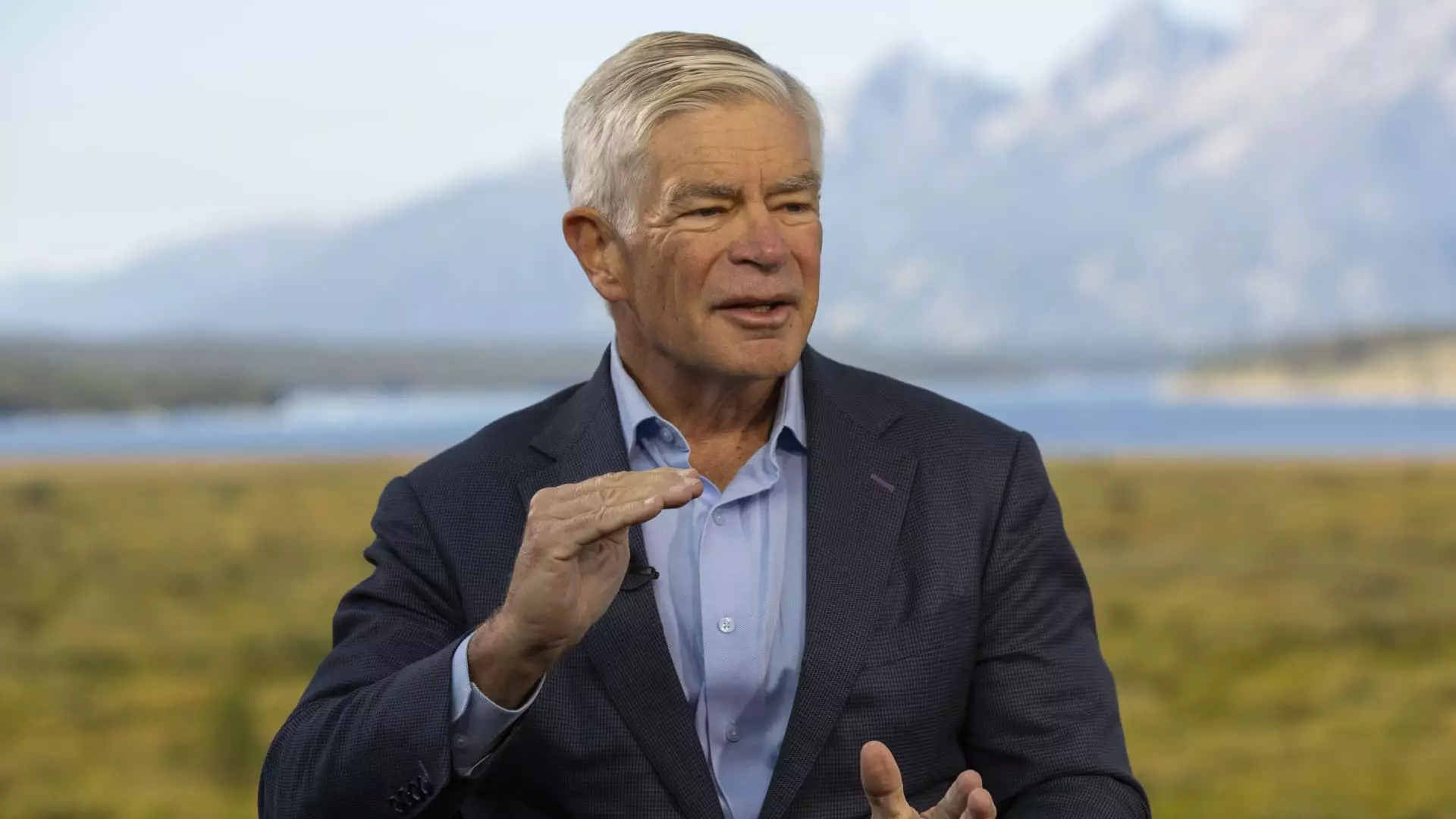

One of the key factors influencing the case for an interest rate cut is the state of the labor market. Kansas City Fed President Jeffrey Schmid highlighted the rising unemployment rate as a significant consideration in the decision-making process. The shift from a tight labor market, which had previously fueled inflation, to a more moderate scenario has prompted policymakers to reassess the need for rate adjustments.

Schmid acknowledged the cooling of job indicators and the steady increase in the unemployment rate as indicators of a changing economic landscape. This shift, combined with a reassessment of inflation expectations, suggests that there is merit in considering a cut in interest rates. While Schmid remains cautious about the overall impact of monetary policy on banks, he recognizes the importance of maintaining a delicate balance between stimulating economic growth and ensuring financial stability.

Both Harker and Schmid emphasized the importance of maintaining the independence of the Federal Reserve from political influence. As the presidential election looms in the background, policymakers are reminded of the need to base their decisions on data rather than external pressures. Harker’s assertion that the Fed operates as proud technocrats underscores the commitment to objective analysis and evidence-based decision-making.

The data-driven approach advocated by both officials reflects a commitment to transparency and accountability in the policymaking process. By focusing on economic indicators and market trends, the Federal Reserve aims to ensure that its decisions are well-grounded and responsive to the evolving economic conditions. The emphasis on data-driven decision-making positions the Fed as a trusted institution dedicated to promoting stability and growth in the economy.

The insights provided by Federal Reserve officials such as Patrick Harker and Jeffrey Schmid offer a nuanced perspective on the case for an interest rate cut in September. The deliberative approach taken by policymakers, coupled with a focus on key economic indicators, highlights the complexity of monetary policy decision-making. As the Fed prepares for its upcoming meeting, the guidance provided by officials underscores the importance of prudence, independence, and data-driven analysis in shaping monetary policy.

Leave a Reply