Recent discussions concerning a potential acquisition between Trump Media and the cryptocurrency trading firm Bakkt have stirred considerable excitement in the markets. Reports indicate that these discussions are at an advanced stage, leading to a remarkable surge in the stock prices of both companies. This unexpected twist provides a window into how business strategies intertwine with the political realm, particularly as the landscape prepares for the 2024 presidential election.

The announcement of Trump Media’s interest in Bakkt led to an immediate and dramatic increase in stock prices. Following the Financial Times report, Trump Media’s shares, which trade under the ticker DJT on the Nasdaq, witnessed a jump of over 16%. Meanwhile, Bakkt’s shares soared by an astonishing 162%, prompting trading halts due to the heightened volatility. This kind of market reaction highlights the intense interest from retail investors, who often react to news with fervent enthusiasm, especially when tied to politically influential figures like former President Donald Trump.

Noteworthy in this scenario is Kelly Loeffler, former CEO of Bakkt and co-chair of Trump’s inauguration committee. This connection raises questions about the potential ramifications of political relationships in business dealings. Loeffler’s political career has seen its fair share of highs and lows, such as her term in the U.S. Senate and subsequent loss in a runoff election. The intertwining of her business past at Bakkt and her political connections to Trump sheds light on how personal networks can influence corporate trajectories.

At face value, Trump Media appears to be in a financially precarious position. The company reported a considerable net loss of $363 million against a revenue of just $2.6 million in its recent fiscal year, yet it boasts a market cap exceeding $7 billion. This discrepancy suggests that the market is valuing Trump Media based more on potential future success than current financial stability. Moreover, the company reportedly holds nearly $673 million in cash, giving it ample runway for strategic investments.

On the flip side, Bakkt has reported mixed financial outcomes since its inception in 2018. It recorded a total revenue of $328.4 million with an operational loss of $27.4 million, despite a noted improvement year-on-year. However, its management has issued caution regarding its future viability, acknowledging the threat of delisting due to consistently low stock prices—an aspect that could deter potential investors and complicate the acquisition discussions.

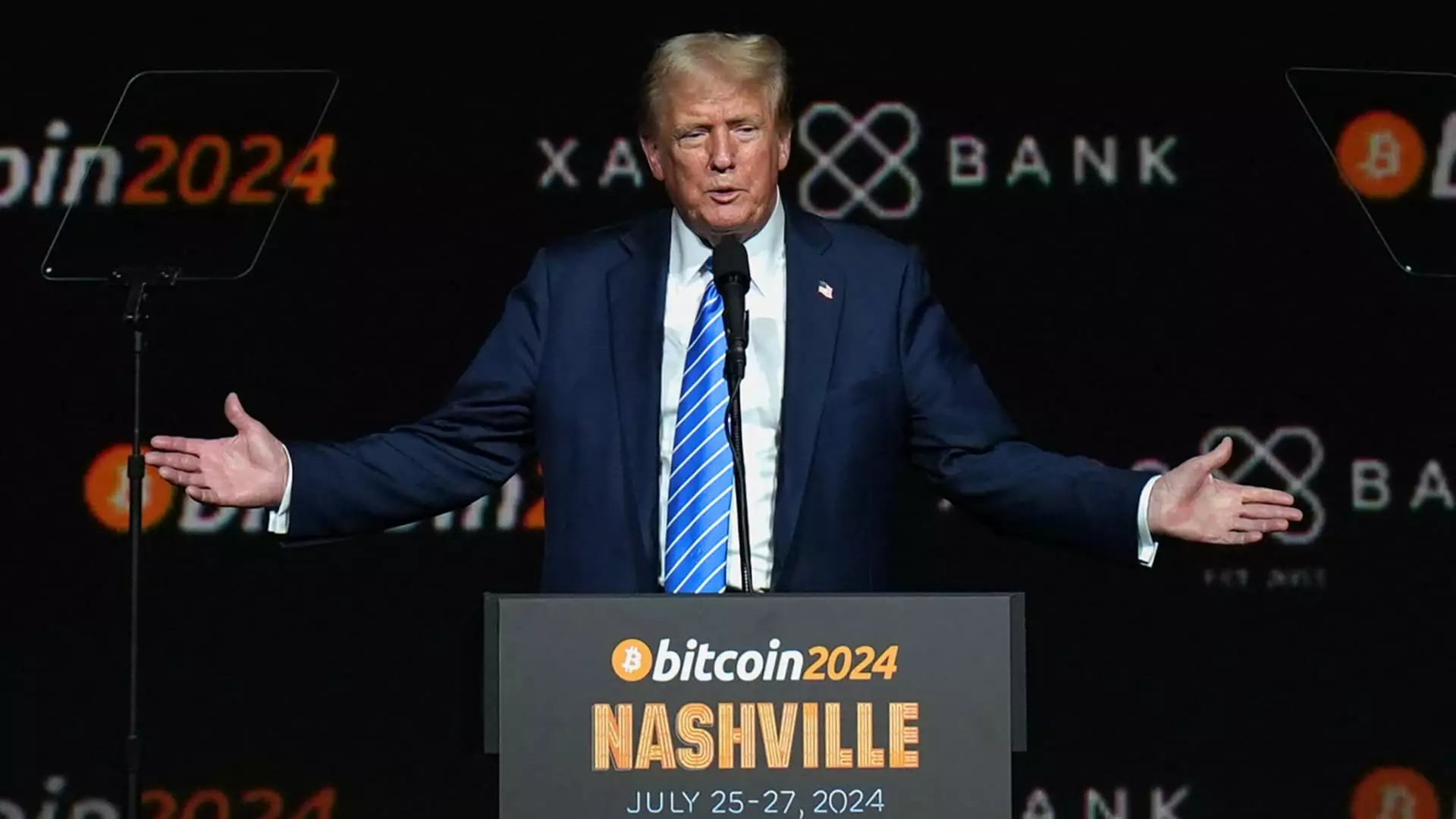

As Trump prepares for a potential return to the presidential office, the acquisition of a cryptocurrency firm can be interpreted as a calculated move to establish a foothold in the burgeoning digital finance realm. Just weeks before the November 5 election, the launch of a new token related to a venture called World Liberty Financial has raised eyebrows. Trump and his family are positioned to significantly benefit from this venture while distancing themselves from any liabilities—a strategic maneuver that reflects a keen understanding of both real estate and the digital economy.

Looking forward, the talks between Trump Media and Bakkt present an interesting intersection of politics, business, and finance. As both entities navigate their financial challenges and capitalize on their respective connections, the outcome could redefine their trajectories ahead of the 2024 election. While the initial market reaction seems overwhelmingly positive, critical eyes will undoubtedly be observing how these strategies unfold amid the high-stakes climate of political influence and economic volatility. Whether this potential deal solidifies into reality or falters remains to be seen, but it undoubtedly highlights how the lines between business operations and political ambitions continue to blur.

Leave a Reply