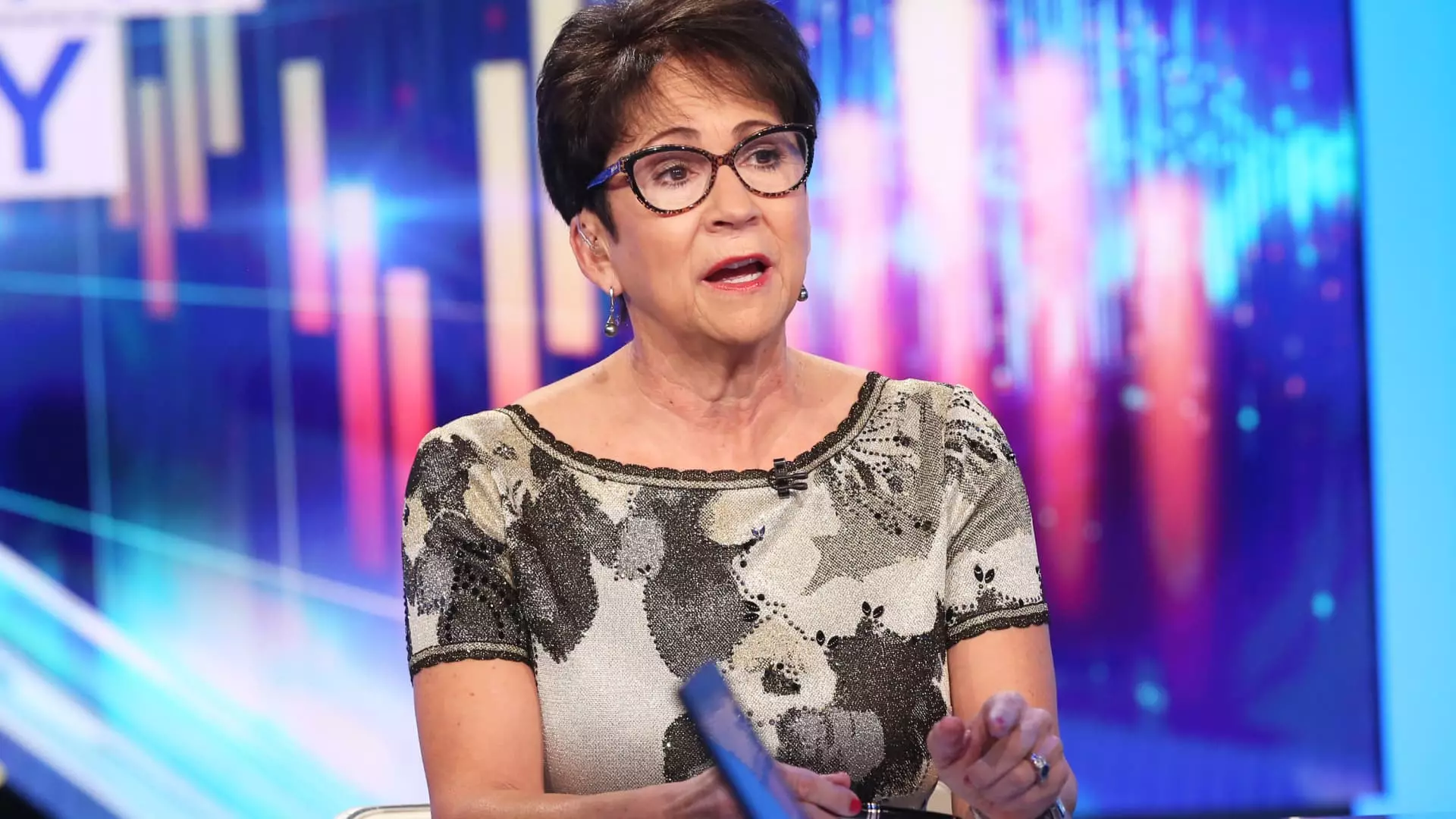

The realm of artificial intelligence (AI) is not limited to tech giants like Nvidia and Meta Platforms. There are opportunities for various industries to capitalize on AI advancements and boost their productivity and profitability. Nancy Tengler, CEO and CIO of Laffer Tengler Investments, emphasizes the potential for old economy companies to embrace digital transformation and leverage generative AI to drive growth.

Tengler highlights industrial and consumer discretionary stocks that have embraced robotics and AI to enhance their operations and bottom line. Companies like Emerson Electric, L3Harris Technologies, Visa, Walmart, and McDonald’s are identified as prime candidates for reaping the benefits of AI investments. These companies are projected to experience sustained growth and stock performance, fueled by AI technologies.

Emerson Electric and L3Harris stand out among industrial companies for their strategic adoption of AI and digitization. Tengler’s firm has recently increased its positions in both companies, underscoring their strong potential for growth. With Emerson Electric’s significant stock price increase and endorsements from top analysts, the company is poised for further success driven by AI-driven automation.

L3Harris, specializing in aerospace and defense, has been leveraging AI and machine learning to enhance its operations. The company’s collaboration with the Defense Department underscores its commitment to delivering cutting-edge AI solutions. Analysts project a positive outlook for L3Harris, attributing its advancements in AI to a potential stock price increase in the near future.

Walmart, a key player in Tengler’s “old economy” AI investment strategy, has seen substantial growth due to its focus on AI integration. The retail giant’s emphasis on e-commerce and automation has propelled its earnings momentum and strengthened its market position. By implementing generative AI in its operations, Walmart has improved efficiency, reduced manual tasks, and achieved significant growth in its e-commerce segment.

Tengler’s investment approach emphasizes a mix of growth and value stocks, including mainstream AI players like Broadcom, Amazon, and Microsoft. By diversifying across different sectors and market segments, Tengler aims to maximize returns while mitigating risks associated with emerging technologies like AI.

Old economy companies have a unique opportunity to harness the power of AI and drive sustainable growth in the digital age. By investing in AI-driven innovators across various industries, investors can capitalize on the transformative potential of artificial intelligence and position themselves for long-term success.

Leave a Reply