In the ever-evolving landscape of financial markets, investors must remain vigilant and informed. Understanding market movements and the underlying factors can often make the difference between profit and loss. Recently, a flurry of activities and announcements has delivered powerful signals that may shape the trading day ahead. In this article, we will explore five crucial themes that are influencing investors as they brace for the trading challenges of today.

The recent performance of major indices has been noteworthy. The S&P 500 recorded a remarkable four consecutive days of gains, surging by 0.75%. Similarly, the technology-heavy Nasdaq Composite outperformed its peers with a 1% increase, as investors flocked to tech stocks. Not to be left behind, the Dow Jones Industrial Average also registered a gain, climbing 235.06 points or 0.58%. These increases have sparked optimism in the markets, especially in light of critical economic indicators. A particularly anticipated figure was the producer price index (PPI)—a key measure for inflation—which showed a modest increase of 0.2% in wholesale prices for August, meeting forecasts. This consistency in data releases is contributing to investor confidence ahead of the Federal Reserve meeting next week, where interest rate discussions will dominate headlines.

Separately, significant labor developments are unfolding at Boeing, where over 30,000 employees have initiated a strike following dissatisfaction with a proposed contract. The timing of this labor disagreement is particularly concerning for the aerospace giant, which has encountered several setbacks over recent months. Factory employees, represented by the International Association of Machinists and Aerospace Workers (IAM), have termed this industrial action an “unfair labor practice strike,” signaling broader implications for labor relations in the corporation. Boeing’s production lines, notably for its best-selling aircraft, will be directly impacted, exacerbating challenges as it seeks to regain stability. The company has expressed its commitment to re-establishing constructive dialogue with staff while emphasizing the necessity of reaching a mutually beneficial agreement.

In the realm of technology and software, Adobe recently released its third-quarter performance, highlighting a congenial increase in sales and profits that placed it above Wall Street’s expectations. Despite this, the anticipated projections for the fourth quarter fell short, causing a sharp decline in premarket trading, with shares dropping approximately 8%. Analysts had anticipated higher earnings per share and sales figures, but Adobe forecasted lower ranges, resulting in investor jitters. Interestingly, the firm did report an 11% increase year-over-year in subscription revenue, suggesting a robust user base. Nevertheless, the guidance provided has overshadowed these positive outcomes, reminding investors of the potential volatility associated with even well-established firms in the tech space.

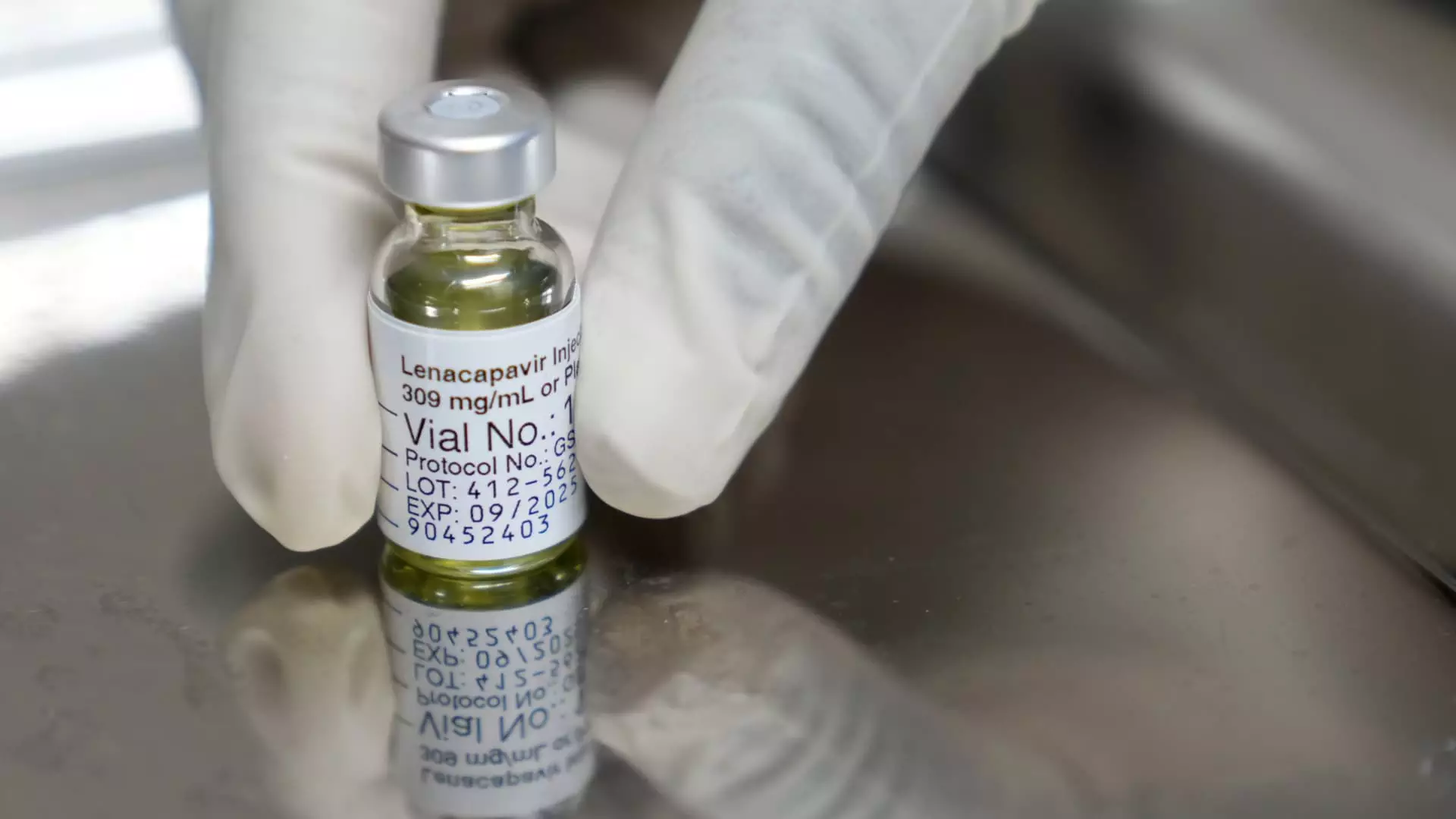

Amidst the corporate challenges, another narrative emerges from the healthcare sector: Gilead’s promising research regarding its HIV treatment, lenacapavir. Recent data from clinical trials revealed a staggering 96% reduction in HIV infections among participants utilizing the drug. Remarkably, only two cases of HIV were reported within a group of 2,180 individuals during the phase-three trial. The compelling results have opened avenues for the U.S. Food and Drug Administration (FDA) to consider approving this breakthrough treatment, which could transform the healthcare landscape for HIV prevention. This news is a beacon of hope, underscoring the continuous innovation within pharmaceuticals and the potential for significant public health impacts.

Finally, the retail sector is abuzz with M&A activity as two major companies, Tapestry and Capri Holdings (owner of Coach and Michael Kors, respectively), prepare for legal discussions regarding their proposed $8.5 billion merger. Although the deal was initially announced over a year ago, regulatory challenges have slowed its progress, with the Federal Trade Commission (FTC) moving to block it on grounds of competition concerns. Both companies now find themselves in a courtroom, articulating their positions on market consolidation and its potential benefits. The outcome of this case could set precedents for future mergers, particularly amid ongoing debates about market concentration and its implications for pricing and employee benefits.

Understanding these critical themes is essential for investors navigating today’s complex market. As they respond to economic indicators, labor disputes, earnings reports, healthcare advancements, and corporate mergers, maintaining an informed perspective is crucial for maximizing opportunities amidst uncertainty.

Leave a Reply