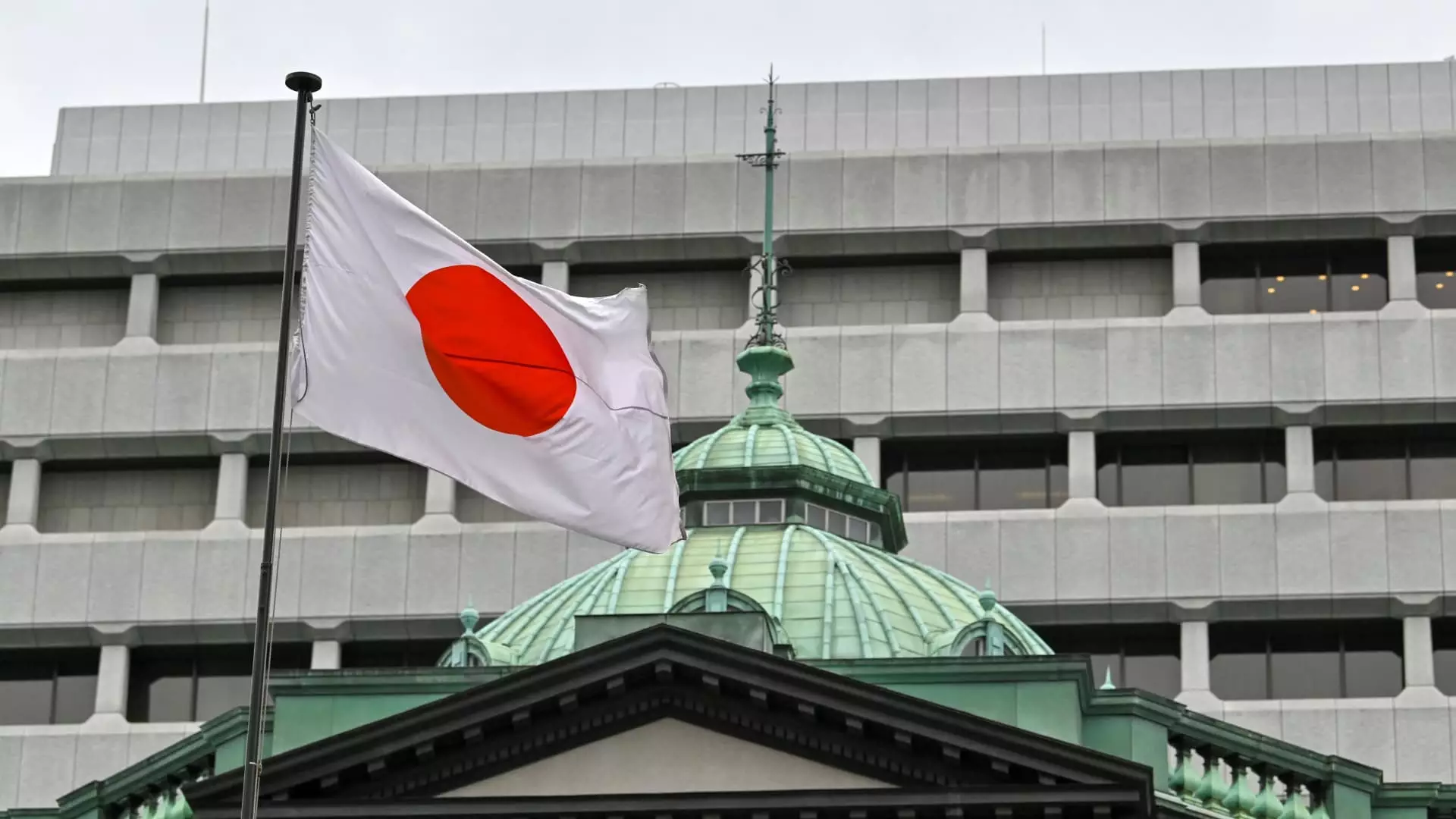

In the wake of global economic shifts, the Bank of Japan (BOJ) has taken a significant step toward normalizing its monetary policy by maintaining its benchmark interest rate at around 0.25%. This rate marks the highest since 2008 and underscores the BOJ’s commitment to recalibrating its approach after years of ultra-low rates designed to stimulate inflation and economic growth. While this decision aligns with expectations, it raises critical discussions about the potential implications for both Japan’s economy and the broader global financial environment.

The BOJ faced the challenging task of balancing the need for policy normalization with the risk of stunting economic recovery. Amid a backdrop of a recovering economy, with some indicators suggesting moderate growth and others revealing underlying weaknesses, the central bank navigates a precarious path. This duality is reflected in the BOJ’s assessment, which mentions a gradual intensification of a virtuous cycle—where increased income leads to higher spending. Nonetheless, such optimism must be weighed against indications of fragility in certain sectors of the economy.

The current economic milieu is further complicated by reactions from other global central banks. For instance, the U.S. Federal Reserve recently cut its interest rates, establishing a contrast to the BOJ’s tightening stance. In such a globally interconnected environment, Japan’s policymakers must consider how domestic decisions will reverberate internationally and affect capital flows, currency values, and trade relationships.

Inflation remains a cornerstone of the BOJ’s strategy; it has been reported that the country’s core inflation, which excludes volatile fresh food prices, is projected to rise through fiscal year 2025. The current figures, which indicate a year-on-year increase of 2.8%, provide a degree of confidence for the BOJ; however, persistent inflation can also act as a double-edged sword. While it may signify a recovering economy, it can also raise the cost of living and provoke pushback from consumers and businesses alike.

Furthermore, excluding fresh food and energy, inflation has also increased, suggesting that various sectors of the economy are feeling the pressure of price hikes. The BOJ’s position on tightening monetary policy is both a response to current inflationary pressures and a proactive measure to contain them, ensuring that inflation expectations remain anchored.

Despite the BOJ’s cautious optimism, there are substantial risks associated with further rate hikes in an environment characterized by uncertain recovery. Economic forecasts indicate a downward revision of Japan’s second-quarter GDP growth, suggesting that the recovery is more tepid than initially envisioned. This misalignment with expectations raises concerns that aggressive monetary tightening may hinder growth, or worse, precipitate an economic downturn.

Stefan Angrick from Moody’s Analytics highlights this precarious balance, warning that while rate hikes are necessary, they could act as a drag on economic activity. This ambiguity raises fundamental questions regarding the sustainability of the BOJ’s approach and the potential for unintended consequences in the context of Japan’s fragile recovery.

The BOJ’s latest interest rate decision symbolizes a critical moment in Japan’s ongoing economic narrative as it strives to transition away from years of extreme accommodative policies. While there is consensus among economists that further rate hikes may be on the horizon, the central bank must navigate carefully to avoid stifling the economic momentum that has taken years to build. As policymakers weigh the potential benefits of tightening monetary policy against risks to growth, Japan’s evolving economic landscape could serve as a bellwether for central banks worldwide grappling with similar dilemmas. The path forward will require vigilance, flexibility, and an acute awareness of both domestic and global economic signals.

Leave a Reply