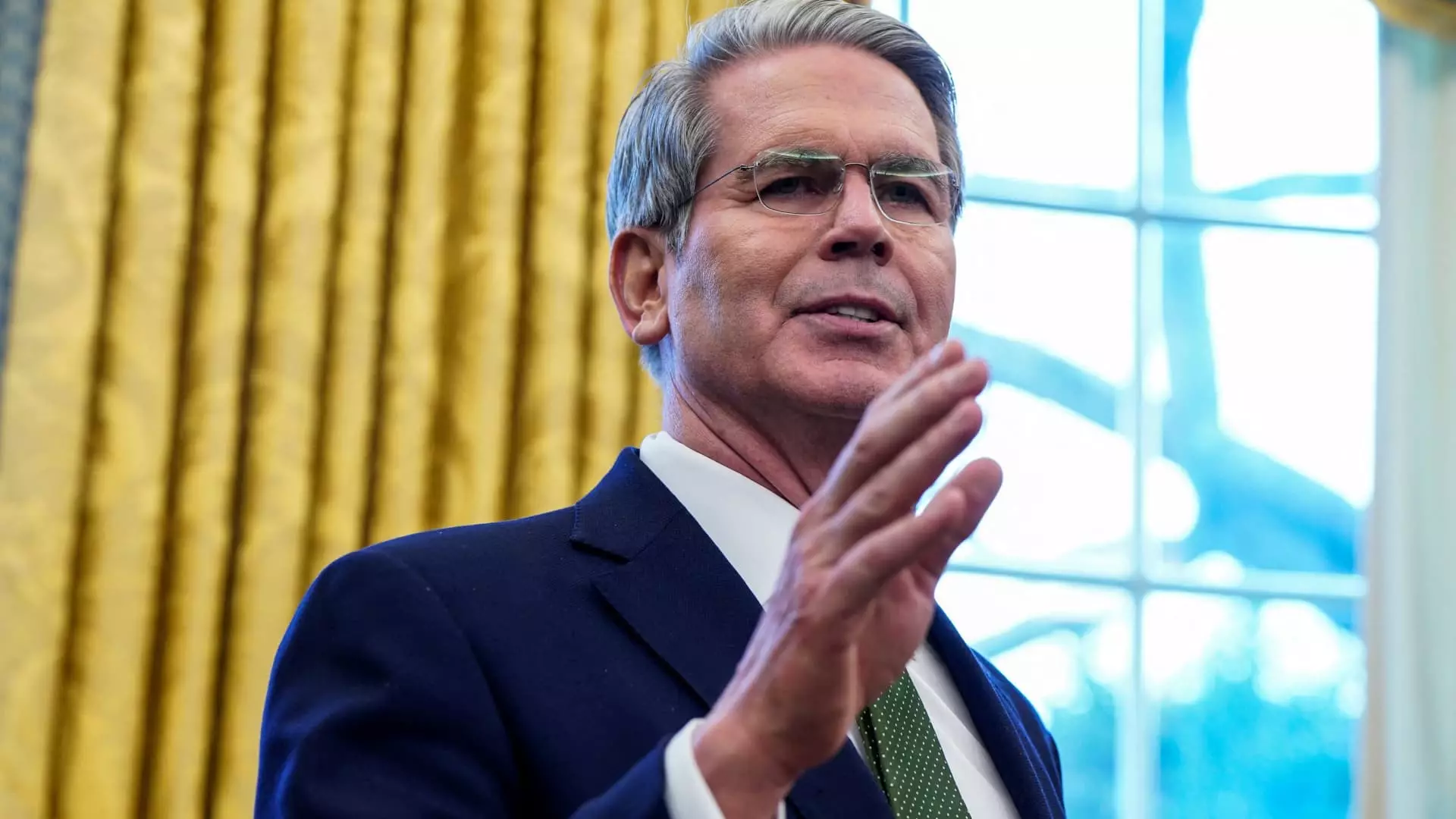

The dynamics between fiscal policy and interest rates continue to evolve within the United States, particularly under the auspices of former President Donald Trump’s administration. Recently, Treasury Secretary Scott Bessent articulated a distinct approach towards Treasury yields, suggesting that the administration is prioritizing fiscal mechanisms over direct interventions by the Federal Reserve. This perspective warrants a deeper examination, considering the implications for the economy and financial markets.

The Shift in Focus: Treasury Yields Over Fed Rates

One of the significant shifts under the Trump administration has been its strategic emphasis on maintaining low Treasury yields, specifically by monitoring the 10-year Treasury note, which is pivotal for various economic sectors. This divergence from the Federal Reserve’s federal funds rate marks a notable policy decision. Traditional economic wisdom suggests that the fed funds rate, which influences short-term borrowing costs, is crucial for shaping broader interest rates, including those for mortgages and loans. However, Bessent’s recent comments imply that the administration is adopting a more nuanced approach that places greater weight on long-term yields.

Bessent pointed out that the administration is not urging the Fed to implement cuts to the benchmark rate as aggressively as in his prior tenure. Instead, the goal is to leverage fiscal policy—through initiatives like tax reform and deregulation—to naturally lower rates. This suggests an intriguing strategy wherein the administration believes that effective management of fiscal responsibilities will create an environment conducive for lower rates autonomously. Bessent remarked, “He [Trump] and I are focused on the 10-year Treasury and what is the yield of that,” highlighting this explicit pivot.

The Fed, beginning in September 2024, entered into a rate-cutting cycle that resulted in a one-point reduction in the funds rate. Intuitively, one might expect that this would facilitate lower borrowing costs across the board, benefitting consumers and businesses alike. However, the outcome has been somewhat paradoxical; rather than seeing a decrease in Treasury yields, there has been a notable uptick. This phenomenon suggests that market participants may have anticipated further monetary easing or inflationary pressures, leading to increased yields—a counterintuitive reaction for a period characterized by lower benchmark rates.

Bessent’s approach reflects a broader philosophical shift: Trump is reportedly advocating for a deregulated economic environment, asserting that a combination of tax incentives and energy policies will catalyze lower rates organically. This notion underscores a belief in the power of free-market principles to shape monetary outcomes without necessitating direct intervention from the Federal Reserve. However, this strategy’s efficacy hinges on the administration’s ability to effectively implement its fiscal agenda.

Forecasting the economic landscape under this paradigm is fraught with uncertainty. Bessent articulated a vision where fiscal prudence—characterized by reducing government size and increasing efficiency—will create favorable conditions for lower interest rates. However, market analysts have cautioned that should the 10-year Treasury yield breach the 5% mark, ramifications could ensue. Such a threshold could signal distress in the economy, potentially leading to downturns in equity markets and housing sectors, both of which are sensitive to interest fluctuations.

The lasting impacts of the Trump administration’s fiscal strategy will be significant. As Bessent mentioned, the administration is keen to make the Tax Cuts and Jobs Act permanent, focusing on driving growth through energy exploration and regulating spending. Whether these initiatives will yield the desired long-term economic stability without excessive risk remains to be seen. Observers will be vigilant in watching these shifts, as their outcomes could critically reshape the economic landscape, influencing everything from consumer sentiment to global market dynamics.

The Trump administration’s approach to Treasury yields marks a significant departure from conventional economic policy. By prioritizing fiscal policy to manage long-term interest rates, the administration presents a bold thesis on economic governance. However, as fiscal aspirations intersect with market realities, maintaining a balance between stimulating growth and preserving financial stability will be critical. This new paradigm, while ambitious, must be navigated carefully to avoid pitfalls that could destabilize the very conditions it seeks to enhance.

Leave a Reply