In an astonishing tale of cybercrime and subsequent punishment, Ilya Lichtenstein’s notorious hack of Bitfinex in 2016 continues to resonate within the cryptocurrency community and the broader legal landscape. The repercussions of Lichtenstein’s actions, which saw approximately 120,000 bitcoins disappear from one of the largest cryptocurrency exchanges, culminated in his sentencing this Thursday to five years in prison for his involvement in a complex money-laundering conspiracy designed to obscure the origins of the stolen wealth.

When Lichtenstein executed his cyberattack, the 120,000 bitcoins had a valuation of around $70 million, an enticing figure for any hacker. However, fast-forward to today, and the same amount of bitcoin is estimated to be worth a staggering $10.5 billion, reflecting the volatile and often unpredictable nature of cryptocurrency valuations. During his attack, Lichtenstein allegedly orchestrated over 2,000 unauthorized transactions, deftly siphoning off these cryptocurrencies without immediate detection. Such a heist not only highlights the vulnerabilities of digital currency exchanges but also underscores the immense potential gains and losses inherent in the cryptocurrency market.

At the recent sentencing, Lichtenstein expressed a desire to take full responsibility, telling Judge Colleen Kollar-Kotelly, “I want to take full responsibility for my actions and make amends any way I can.” This statement raises questions about the sincerity of remorse in cases of significant cybercrime, where the primary motivation is often financial gain. The juxtaposition of his admitted regret against the backdrop of calculated schemes suggests a complicated relationship between morality, legality, and the allure of instant wealth that cryptocurrencies present.

Lichtenstein’s plea, made during a hearing in August 2023, revealed his role in the high-profile hack, marking a pivotal moment not just for him but for other players in the cryptocurrency space who may be watching closely. Acknowledging this criminal act sheds light on how individuals deeply involved in the virtual currency world grapple with their decisions once the ramifications become real and irreversible.

Prosecutors painted a grim picture of Lichtenstein’s methodology, referring to him as “one of the greatest money launderers that the government has encountered in the cryptocurrency space.” The court heard that over the subsequent five years, he employed what amounted to the most intricate money-laundering techniques observed by IRS agents. This reveals an unsettling reality about cybercriminals today—they are organized and knowledgeable, using sophisticated tools to obscure their activities. The findings highlight the critical need for regulatory measures in the crypto space, as many exchanges may lack robust defenses against such brazen tactics.

Though Lichtenstein received a relatively light sentence—five years in prison, with potential for early release due to good behavior—his case serves as a cautionary tale. Owning up to criminal actions in a courtroom may provide some semblance of redemption, but the vast expanse of consequences, both legal and moral, remains undeniable.

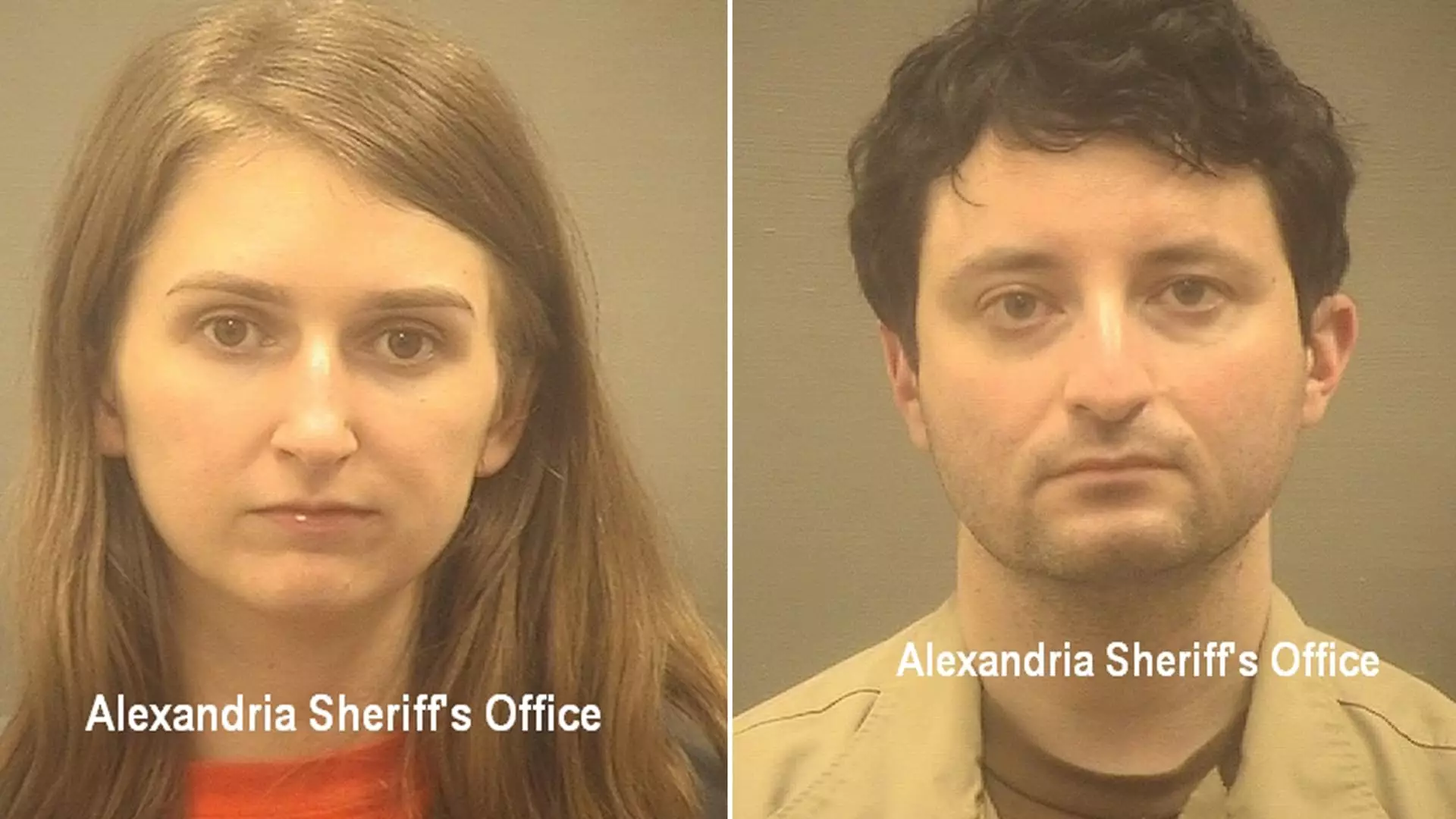

Complicating this narrative is the fate of Lichtenstein’s wife, Heather Rhiannon Morgan, who also participated in the money-laundering scheme. While prosecutors classify her as a “lower-level participant,” her role still brings significant attention to the ethical dilemmas facing individuals connected to cybercrimes. Morgan is scheduled to face her sentencing soon, with prosecutors recommending 18 months in prison. The outcome not only affects her future but also underscores the nuances of culpability when multiple parties are involved in a conspiracy.

The Department of Justice’s successful recovery of over 94,000 of the stolen bitcoins, valued at an impressive $3.6 billion at the time of the arrest, denotes a crucial step toward restoring some measure of order following the upheaval caused by Lichtenstein’s actions. Prosecutors anticipate that nearly all of these assets will be returned to Bitfinex or other rightful owners through restitution efforts. This aspect of the case provides a silver lining, indicating that while cybercrimes can be devastating, law enforcement agencies are equipped to fight back and recover from unprecedented thefts in the digital realm.

The saga of Ilya Lichtenstein is emblematic of the complex interplay between innovation in cryptocurrency, the vulnerabilities of such systems, and the justice system’s response to cybercrime. As the digital landscape continues to evolve, so too will the strategies employed by both criminals and those who seek to halt their actions. The lessons learned from this case are not merely academic—they are vital for anyone navigating the rapidly changing world of cryptocurrency.

Leave a Reply