China’s economy faced a slow recovery from the Covid-19 pandemic in 2023, with a 5.2% growth rate in gross domestic product. This was lower than many had expected due to various factors such as a prolonged slump in the real estate market and falling global demand for Chinese exports. As a result, levels of consumer and business sentiment remained low, raising questions about whether Beijing would provide significant economic stimulus.

Authorities in Beijing have been relatively reserved in signaling any new policy support. Chief economist at Huatai Asset Management, Wang Jun, mentioned that any stimulus measures implemented this time would not be as significant as the massive ones rolled out back in 2008 during the financial crisis. This cautious approach reflects a more measured response to economic challenges compared to previous years.

China’s monetary policy currently faces constraints concerning how far it can deviate from the U.S. Federal Reserve’s interest rate path. This limits the options available for policymakers in Beijing when it comes to adjusting interest rates to stimulate economic growth. The need to balance domestic monetary policy with global market trends adds another layer of complexity to the situation.

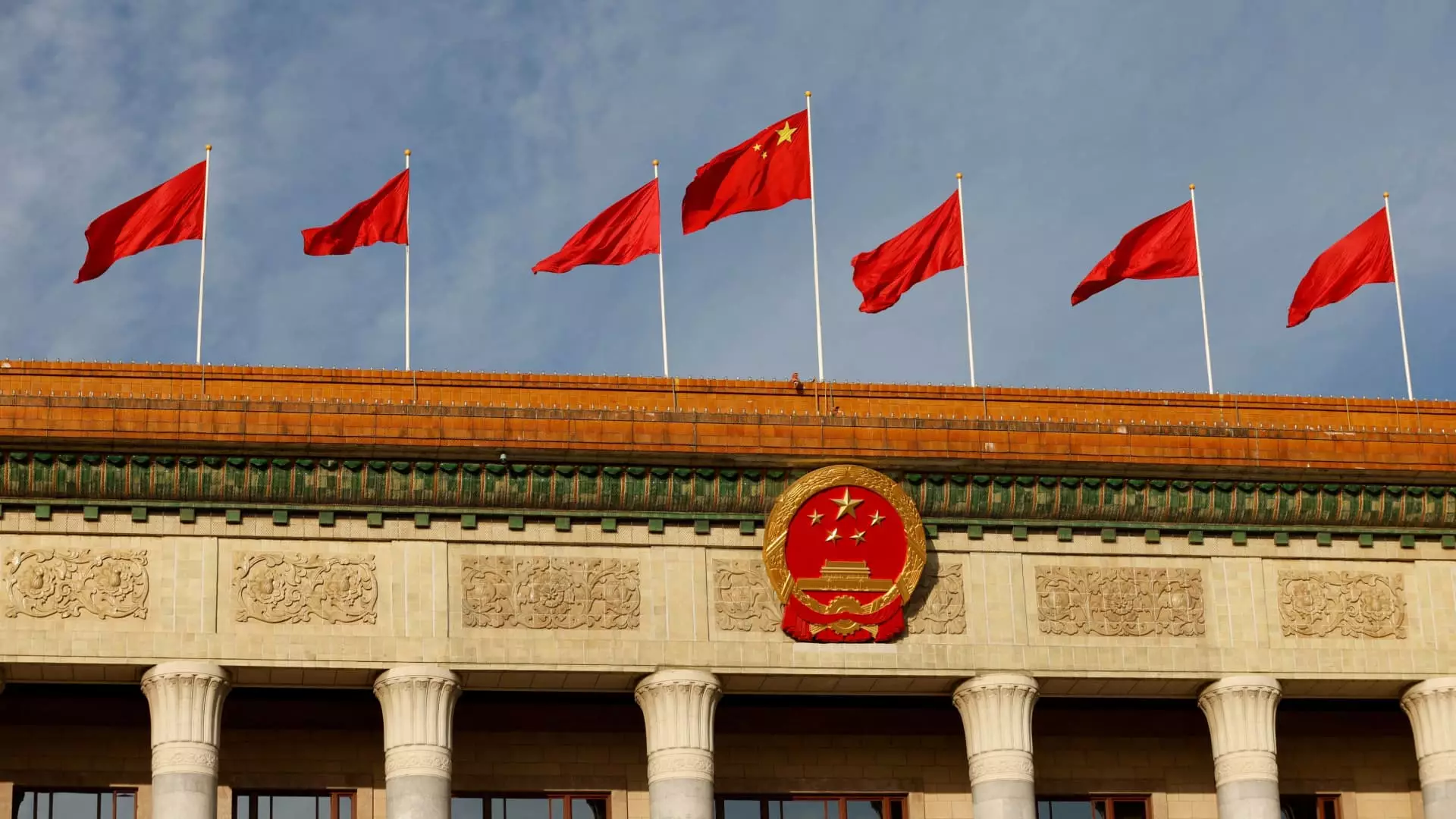

The upcoming meetings known as the “Two Sessions” provide an opportunity for Chinese leadership to delve into key economic policy areas such as real estate, capital markets, and local government finances. These sessions are crucial for outlining policy plans, including setting the GDP target for the year ahead. Additionally, these meetings are where detailed discussions on fiscal deficit targets, monetary policy stance, and other economic indicators take place.

There are expectations that policymakers will send signals on potential business opportunities for foreigners and improvements in the environment for non-state-owned enterprises. These moves aim to make the Chinese market more attractive to international investors and foster a more diverse economic landscape. However, concrete details on implementation are usually left to individual ministries following directives from Beijing.

Despite the challenges faced by the Chinese economy, there is optimism regarding a gradual recovery in the coming year. Wang from Huatai Asset Management anticipates that the economy will improve gradually, with nominal GDP outperforming real GDP. This projected recovery could lead to increased confidence among consumers and businesses, providing a more tangible sense of progress.

China’s economic policy outlook remains a subject of keen interest both domestically and internationally. As the country navigates through various economic challenges, the measured approach taken by authorities signals a cautious stance towards implementing large-scale stimulus measures. The upcoming parliamentary meetings will shed light on key policy decisions and targets for the year ahead, offering crucial insights into the direction of China’s economic policy in 2023.

Leave a Reply