The first half of 2023 has seen exchange-traded funds (ETFs) linked to the artificial intelligence (AI) boom perform exceptionally well. However, as investors weigh the tech-driven hype against higher interest rates, momentum is shifting. According to Global X Chief Investment Officer Jon Maier, the impact of interest rates is causing the markets to reconsider their investments. Despite this, Maier highlights that the components within these AI-focused ETFs continue to work cohesively.

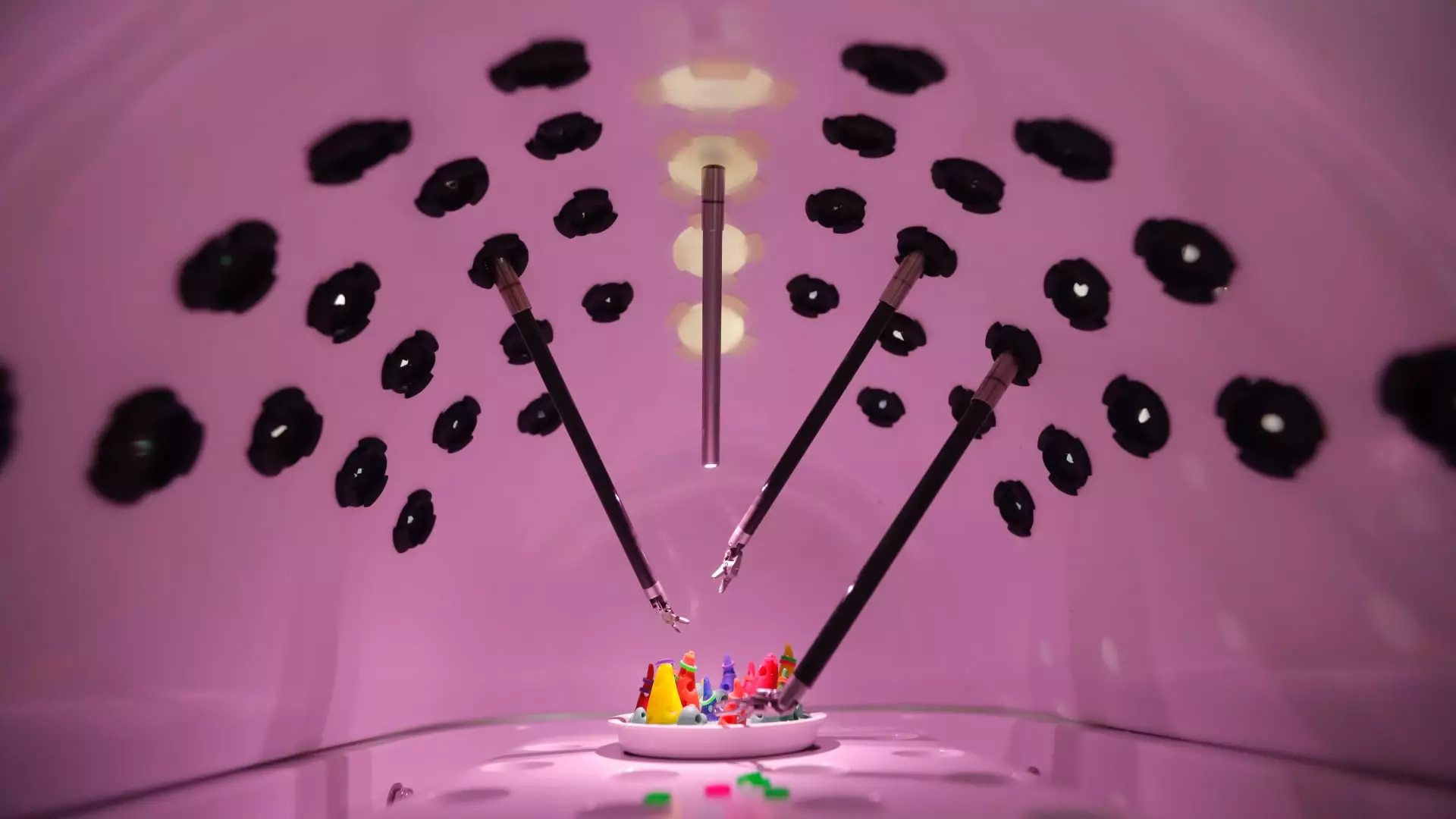

Global X operates two AI funds, one of which is the Robotics and Artificial Intelligence ETF (BOTZ). While Nvidia holds the largest position in BOTZ, the fund also includes industrial robotics and automation companies such as Intuitive Surgical, Keyence, and Dynatrace. Maier emphasizes the importance of industrials, as they contribute to enhancing the efficiency of other companies rather than solely relying on AI technology.

BOTZ has been a primary beneficiary of the AI advancement, attracting $594 million in inflows this year, as reported by FactSet. Year-to-date, the ETF has seen a more than 25% increase in value, peaking in July 2023 before gradually subsiding in subsequent months.

Todd Sohn, ETF and technical strategist at Strategas Securities, believes that industrials offer an intriguing under-the-radar narrative that investors should closely consider. Sohn highlights the success of the Industrial Select Sector SPDR Fund (XLI), which has experienced an almost 8% increase in value this year and received over $903 million in inflows.

In contrast, broad tech-themed ETFs have been experiencing net outflows in 2023. The iShares U.S. Technology ETF (IYW) has witnessed over $551 million in outflows, while the Technology Select Sector SPDR Fund (XLK) has recorded nearly $2.06 billion in outflows. Sohn suggests that investors, concerned about higher interest rates and inflation, are shifting away from the broader tech rally and exploring more focused investments like AI.

Despite moving towards industrials, tech remains a significant factor in Global X’s more mainstream Artificial Intelligence & Technology ETF (AIQ). However, the ETF only holds a maximum 3% of the largest mega-cap tech companies, avoiding a concentration in these positions. AIQ has performed impressively, with an almost 37% increase in value year-to-date and attracting $344 million in inflows in 2023.

Maier emphasizes the significance of data in AI and its connection to larger companies such as Amazon, Alphabet, and Meta Platforms. These companies possess the capability to retain the required data for effective AI implementation. While the future of AI is still uncertain, data is currently the driving force.

For investors seeking diversification beyond the tech wave, Sohn asserts that industrials offer significant potential due to the rise of AI-induced efficiency and productivity in robotics and automation companies. Sohn suggests that it is relatively easy to overweight industrials, as they constitute approximately 9% of the S&P 500, compared to information technology’s 28% weight in the index.

As interest rates continue to influence investor sentiments, the momentum of AI-focused ETFs is undergoing a shift. While tech-driven ETFs experience outflows, those focusing on industrials and AI maintain their appeal. By recognizing the importance of diversification and considering investments beyond the tech sector, investors can potentially capitalize on the efficiency and productivity advancements in AI-driven robotics and automation companies.

Leave a Reply