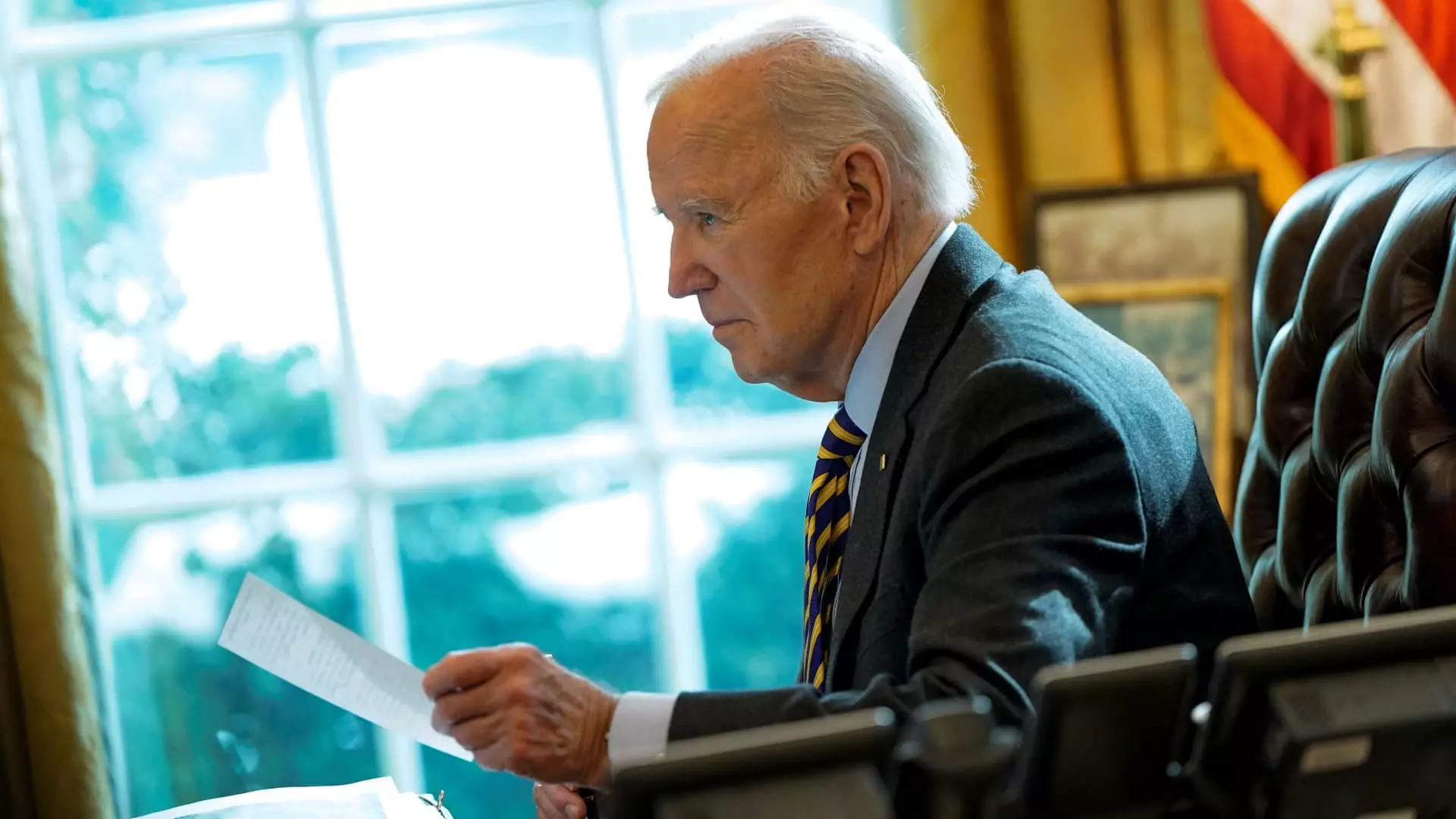

The recent decision by the Biden administration to delay the order for Nippon Steel to relinquish its proposed $14.9 billion acquisition of U.S. Steel underscores the complexities that lie at the intersection of national security, economic policy, and international relations. The original block by President Biden on January 3 was motivated by concerns over national security, reflecting growing apprehensions surrounding foreign investments in significant U.S. assets. This article examines the implications of this delay and the broader context in which it occurs, including the responses from both Japanese and American stakeholders.

National security has become an increasingly vital topic in the discourse surrounding foreign acquisitions of American companies. The Treasury Secretary, Janet Yellen, noted that the deal underwent a meticulous review courtesy of the Committee on Foreign Investment in the United States (CFIUS). CFIUS’s role is fundamentally to scrutinize foreign investments, assessing potential risks to national security. Historically, cases involving countries allied with the U.S., such as those belonging to the Group of Seven, undergo less intense scrutiny. Thus, the blocking of this transaction raises critical questions about the shifting attitudes toward foreign direct investments, even from allies.

Biden’s decision to halt the acquisition is emblematic of a broader trend among policymakers to prioritize national interests in the face of globalization. The steel industry is a crucial component of the United States’ industrial backbone, and allowing foreign entities to acquire domestic steel producers may raise risks in terms of supply chain reliability and strategic independence.

The companies involved, Nippon Steel and U.S. Steel, filed a legal challenge against the administration, asserting that the CFIUS review was unduly influenced by Biden’s public opposition to their proposed merger. This perspective reveals a layer of complexity within the legal framework governing foreign investments in the U.S. The assertion that they were denied a fair review could set a historical precedent if a court were to agree that political biases influenced the operations of national security reviews.

The extension provided until June 18, 2025, offers the parties critical breathing room to push their case legally. Both companies express confidence that the merger would benefit all stakeholders involved, suggesting a belief that this deal could enhance the competitiveness of the American steel industry while simultaneously benefiting Nippon Steel as a key player in global steel production. However, the question remains: at what cost to national security and economic independence?

Japanese Foreign Minister Takeshi Iwaya’s statements following Biden’s announcement point to a broader concern about the potential impact on U.S.-Japan relations. Japan has historically been the largest investor in the United States, creating thousands of jobs and contributing to regional and local economies. Iwaya articulated unease within the Japanese business community regarding the implications of the acquisition’s denial and called for an effective resolution to avoid disrupting the vital U.S.-Japan alliance.

The diplomatic ramifications of this acquisition’s status reflect the fragile equilibrium within which international relations operate. While both nations enjoy a robust economic partnership, incidents like this could provoke tensions, especially in a global landscape that is increasingly fraught with competition and challenges related to trade.

As the Biden administration reevaluates its stance towards foreign acquisitions, observers will be keenly watching how this situation unfolds. The political ramifications of the administration’s decisions—especially with the upcoming elections—could influence policy direction and public sentiment more broadly. Indeed, the steel industry, in particular, has significant implications for labor, economic growth, and national security.

The tension between maintaining robust international investment avenues and safeguarding national interests raises fundamental questions about the future of economic policy in the United States. While this case may be a singular event, it signifies a turning point in the scrutiny that foreign investments face, with potential repercussions extending far beyond the steel industry and into various sectors of the American economy.

Leave a Reply