Nvidia, the leading chipmaker, saw a significant boost in its shares, climbing 6% in extended trading on Wednesday. This surge in stock value came after the company not only exceeded expectations for its fiscal second quarter but also issued an optimistic guidance for the current period. Let’s take a deeper look into Nvidia’s performance and explore the key factors driving its success.

Impressive Financial Results

Nvidia’s fiscal second-quarter earnings surpassed expectations, with adjusted earnings per share of $2.70 compared to the estimated $2.09 per share. Moreover, the company reported a revenue of $13.51 billion, significantly surpassing the expected $11.22 billion. These outstanding financial results showcase Nvidia’s strong market position and successful strategies in the industry.

Positive Guidance for the Future

The chipmaker’s optimistic guidance for the upcoming fiscal third quarter further fueled investors’ confidence. Nvidia expects a revenue of approximately $16 billion for the current period, a notable increase compared to the estimated $12.61 billion forecast. This guidance implies a substantial growth of 170% in sales compared to the same period last year. The positive outlook reflects Nvidia’s anticipation of continued success and market dominance.

Generative AI Boom

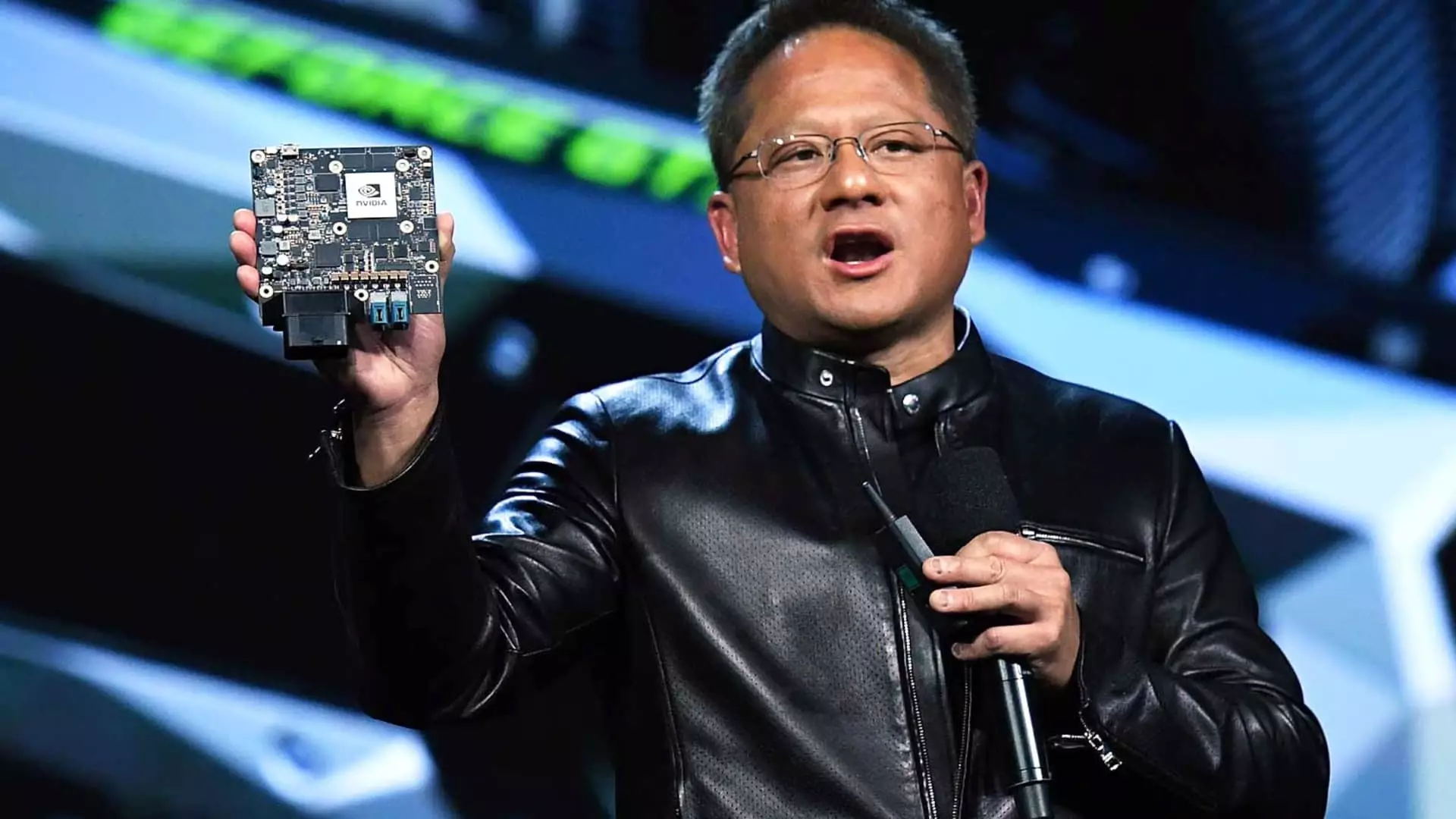

One of the key drivers behind Nvidia’s success is the increasing demand for its graphics processing units (GPUs) in the generative AI sector. Nvidia’s A100 and H100 AI chips are essential for building and running AI applications like OpenAI’s ChatGPT, which enables conversational responses and image generation from simple text queries. The growing reliance on AI technologies in various industries has solidified Nvidia’s position as a key player in the market.

Strong Growth in Data Center Business

Nvidia’s data center business, including AI chips, was instrumental in driving the company’s impressive performance. With cloud service providers and major consumer internet companies like Alphabet, Amazon, and Meta adopting next-generation processors, Nvidia’s revenue from the data center group reached $10.32 billion, marking a remarkable 171% year-over-year growth. This figure surpassed the estimated revenue of $8.03 billion, as reported by StreetAccount.

Amid proposed export restrictions on chips by the Biden administration, Nvidia remains confident in its ability to withstand immediate impacts. The company’s finance chief, Colette Kress, stated on an earnings call that they do not expect additional export restrictions on their data center GPUs to have a substantial material effect on their financial results. This resilience showcases Nvidia’s adaptability and diversified business strategy.

Diverse Revenue Streams

While Nvidia’s core business used to be in the gaming division, the company has successfully diversified its revenue streams. The gaming division still experienced steady growth, with a 22% increase in revenue to $2.49 billion compared to the previous year’s figure of $2.38 billion. Additionally, Nvidia’s involvement in high-end graphics applications and automotive chips further contributed to its success, generating revenue of $379 million and $253 million, respectively.

Recognizing its strong financial position, Nvidia’s board of directors authorized $25 billion in share buybacks. This move demonstrates the company’s commitment to creating shareholder value and confidence in its future growth prospects. The strong financial performance and positive outlook have also propelled Nvidia’s stock price, which has more than tripled this year. With the stock reaching around $500 after hours, Nvidia has the potential to achieve a new record high, surpassing its prior closing peak of $474.94.

Nvidia’s fiscal second-quarter performance and optimistic guidance for the third quarter reflect the chipmaker’s remarkable success and market dominance. The increasing demand for Nvidia’s GPUs in generative AI applications, along with its strong growth in the data center business, have played key roles in its exceptional performance. Despite potential challenges posed by export restrictions, Nvidia remains confident in its resilience. With diversified revenue streams and a commitment to shareholder value through share buybacks, Nvidia is poised for continued growth and success in the industry.

Leave a Reply